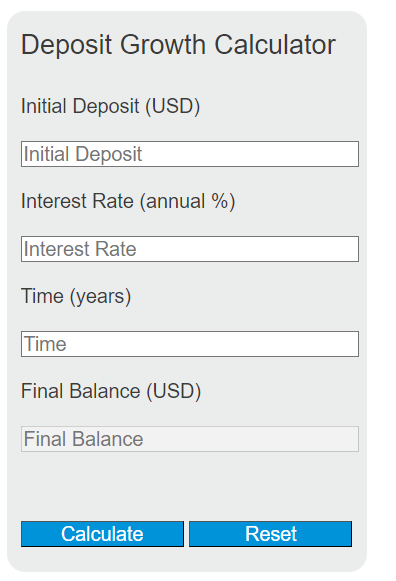

Enter the initial deposit, annual interest rate, and time in years into the calculator to determine the growth of your deposit over time. This calculator uses compound interest to calculate the final balance of your deposit.

Deposit Growth Formula

The following formula is used to calculate the final balance of a deposit using compound interest.

FB = P * (1 + r)^t

Variables:

- FB is the final balance of the deposit (USD)

- P is the initial deposit (USD)

- r is the annual interest rate (expressed as a decimal)

- t is the time the money is invested or borrowed for, in years

To calculate the final balance of a deposit, multiply the initial deposit by one plus the annual interest rate raised to the power of the number of years the money is invested.

What is Deposit Growth?

Deposit growth refers to the increase in the balance of a deposit over time due to the accrual of interest. This growth is typically the result of compound interest, where the interest earned each period is added to the principal sum, and future interest is then earned on the new total. It is a fundamental concept in finance and banking, particularly for savings accounts, certificates of deposit, and other investment vehicles.

How to Calculate Deposit Growth?

The following steps outline how to calculate the Deposit Growth.

- First, determine the initial deposit (P).

- Next, determine the annual interest rate (r) and convert it to a decimal by dividing by 100.

- Next, determine the time the money is invested for (t) in years.

- Next, gather the formula from above = FB = P * (1 + r)^t.

- Finally, calculate the final balance (FB) of the deposit.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Initial deposit (P) = $1,000

Annual interest rate (r) = 5%

Time (t) = 10 years