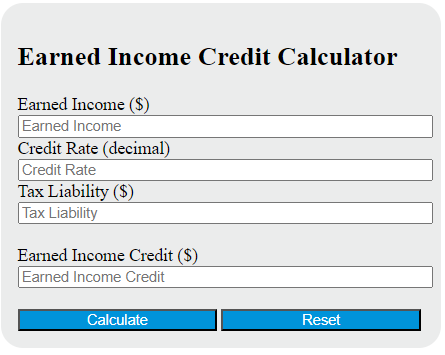

Enter the earned income and credit rate into the calculator to determine the Earned Income Credit.

Earned Income Credit Formula

The following formula is used to calculate the Earned Income Credit (EIC).

EIC = (E * r) - T

Variables:

- EIC is the Earned Income Credit ($)

- E is the earned income ($)

- r is the credit rate (decimal)

- T is the tax liability ($)

To calculate the Earned Income Credit, multiply the earned income by the credit rate. Then subtract the tax liability from the result.

What is an Earned Income Credit?

The Earned Income Credit (EIC) is a refundable tax credit in the United States designed to benefit low to moderate-income working individuals and families. The credit amount varies depending on the taxpayer’s income and number of dependents. It is intended to reduce the tax burden on these individuals, potentially reducing their tax liability to zero or even resulting in a refund if the credit is more than the amount of tax owed.

How to Calculate Earned Income Credit?

The following steps outline how to calculate the Earned Income Credit (EIC) using the given formula:

- First, determine the earned income (E) ($).

- Next, determine the credit rate (r) (decimal).

- Next, determine the tax liability (T) ($).

- Next, gather the formula from above = EIC = (E * r) – T.

- Finally, calculate the Earned Income Credit (EIC).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge:

earned income (E) ($) = 5000

credit rate (r) (decimal) = 0.2

tax liability (T) ($) = 1000