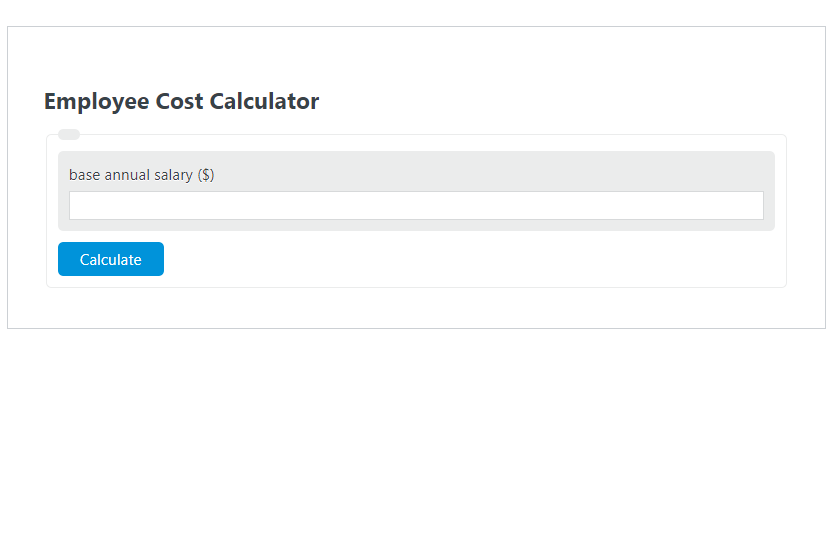

Enter the base annual salary ($) into the Employee Cost Calculator. The calculator will evaluate and display the Employee Cost.

- All Cost Calculators

- Cost Per Employee Calculator

- Total Cost Calculator

- Stock Average Cost Calculator

Employee Cost Formula

The following formula is used to calculate the Employee Cost.

EC = BS * 1.4

- Where EC is the Employee Cost ($)

- BS is the base annual salary ($)

To calculate the actual employee cost, multiply the base annual salary by 1.4.

How to Calculate Employee Cost?

The following example problems outline how to calculate Employee Cost.

Example Problem #1:

- First, determine the base annual salary ($). The base annual salary ($) is given as 75,000.

- Finally, calculate the Employee Cost using the equation above:

EC = BS * 1.4

The values given above are inserted into the equation below:

EC = 75,000 * 1.4 = 105,000 ($)

FAQ

What factors contribute to the 1.4 multiplier in the Employee Cost formula?

The 1.4 multiplier in the Employee Cost formula accounts for additional costs associated with employing someone beyond their base salary. These can include taxes, benefits, equipment, training, and other overhead expenses that an employer must cover.

Can the Employee Cost formula be used for part-time employees?

Yes, the Employee Cost formula can be adapted for part-time employees by adjusting the base annual salary to reflect their part-time earnings. However, the multiplier may need to be adjusted based on the specific benefits and costs associated with part-time employment.

How does the Employee Cost impact budgeting and financial planning for businesses?

Understanding the true cost of an employee is crucial for budgeting and financial planning. It helps businesses accurately forecast expenses, make informed hiring decisions, and manage resources efficiently. By accounting for the total cost of employment, businesses can better plan for growth and sustainability.