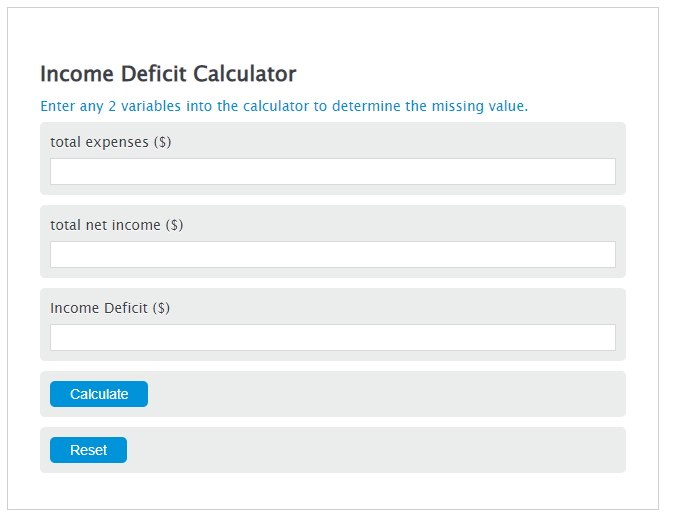

Enter the total expenses ($) and the total net income ($) into the Calculator. The calculator will evaluate the Income Deficit.

Income Deficit Formula

ID = E - NI

Variables:

- ID is the Income Deficit ($)

- E is the total expenses ($)

- NI is the total net income ($)

To calculate Income Deficit, subtract the total net income from the total expenses.

How to Calculate Income Deficit?

The following steps outline how to calculate the Income Deficit.

- First, determine the total expenses ($).

- Next, determine the total net income ($).

- Next, gather the formula from above = ID = E – NI.

- Finally, calculate the Income Deficit.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total expenses ($) = 3000

total net income ($) = 2000

FAQs

What is the significance of calculating Income Deficit?

Calculating Income Deficit is crucial for individuals and businesses to understand their financial health. It helps in identifying whether the expenses exceed the net income, indicating a need for budget adjustments or finding ways to increase income.

How can an Income Deficit be improved?

Improving an Income Deficit involves either reducing total expenses or increasing total net income. This can be achieved through budgeting, cost-cutting measures, or finding ways to enhance revenue streams.

Are there any tools or software recommended for tracking Income Deficit?

Yes, there are several financial planning and budgeting tools available online that can help track Income Deficit. Software such as Quicken, Mint, and YNAB (You Need A Budget) are popular choices for personal and small business financial management.

Can Income Deficit have long-term impacts?

Yes, a persistent Income Deficit can lead to accumulating debt, reduced savings, and potential financial instability. It’s important to address Income Deficits early to avoid long-term financial consequences.