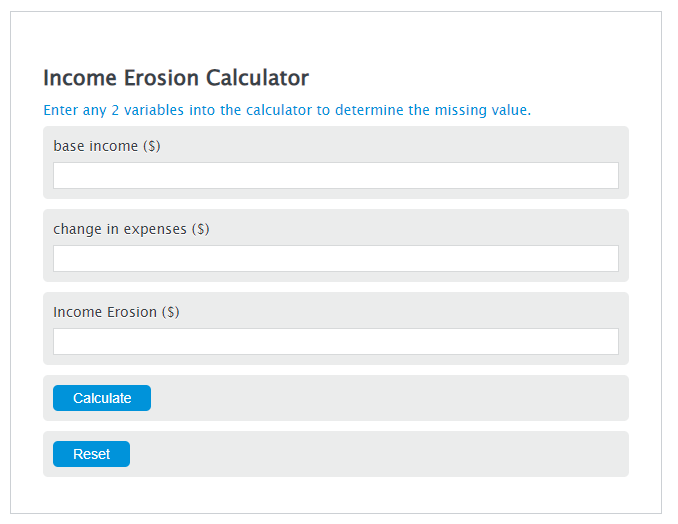

Enter the base income ($) and the change in expenses ($) into the Calculator. The calculator will evaluate the Income Erosion.

Income Erosion Formula

IE = BI - CE

Variables:

- IE is the Income Erosion ($)

- BI is the base income ($)

- CE is the change in expenses ($)

To calculate Income Erosion, subtract the change in expenses from the base income.

How to Calculate Income Erosion?

The following steps outline how to calculate Income Erosion.

- First, determine the base income ($).

- Next, determine the change in expenses ($).

- Next, gather the formula from above = IE = BI – CE.

- Finally, calculate the Income Erosion.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

base income ($) = 4000

change in expenses ($) = 200

Frequently Asked Questions

What is base income?

Base income refers to the regular, consistent income an individual or entity receives before any deductions, taxes, or changes in expenses. It can include wages, salaries, and other forms of steady earnings.

How can change in expenses impact financial stability?

A change in expenses, whether an increase or decrease, can significantly impact financial stability. An increase in expenses without a corresponding increase in income can lead to income erosion, reducing the amount of disposable income available for savings or investments. Conversely, a decrease in expenses can enhance financial stability by increasing disposable income.

Why is it important to calculate income erosion?

Calculating income erosion is important because it helps individuals and businesses understand how changes in expenses affect their net income. This understanding can lead to better financial planning and decision-making to ensure financial stability and growth.

Can income erosion be reversed or mitigated?

Yes, income erosion can be mitigated through various strategies such as increasing the base income through additional sources of revenue, reducing unnecessary expenses, or optimizing existing expenses. Financial planning and budgeting are key to managing and reversing income erosion.