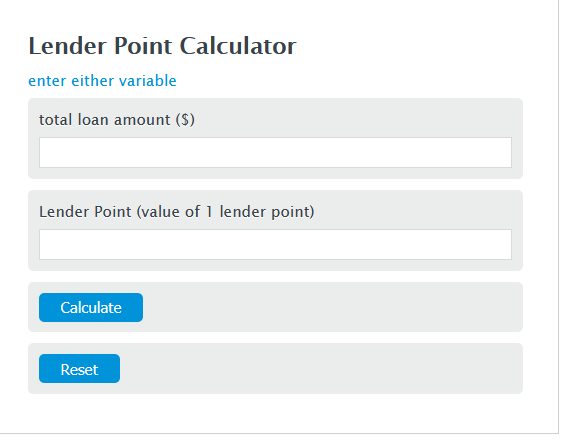

Enter the total loan amount ($) into the Calculator. The calculator will evaluate the Lender Point value.

Lender Point Formula

LP = LA * .01

Variables:

- LP is the Lender Point (value of 1 lender point)

- LA is the total loan amount ($)

To calculate Lender Points, multiply the total loan value by .01.

How to Calculate Lender Points?

The following steps outline how to calculate the Lender Point.

- First, determine the total loan amount ($).

- Next, gather the formula from above = LP = LA * .01.

- Finally, calculate the Lender Point.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total loan amount ($) = 3000000

FAQs

What are Lender Points?

Lender Points, often referred to as discount points, are fees paid directly to the lender at closing in exchange for a reduced interest rate. This can lower your monthly mortgage payments.

How do Lender Points affect my mortgage?

Each point typically lowers the rate on a fixed-rate mortgage by 0.25%, but this can vary. Paying points can save you money over the life of your loan if you plan to stay in your home for a long time.

Are Lender Points tax deductible?

Yes, mortgage points are tax deductible, but it has to be in the year you paid them if they’re for a home purchase. For refinancing, the deduction may be spread out over the life of the loan.

Is it always beneficial to pay for Lender Points?

It depends on your financial situation and how long you plan to stay in your home. It’s beneficial if you plan to stay in your home long enough to recoup the costs of buying the points through your reduced monthly mortgage payments.