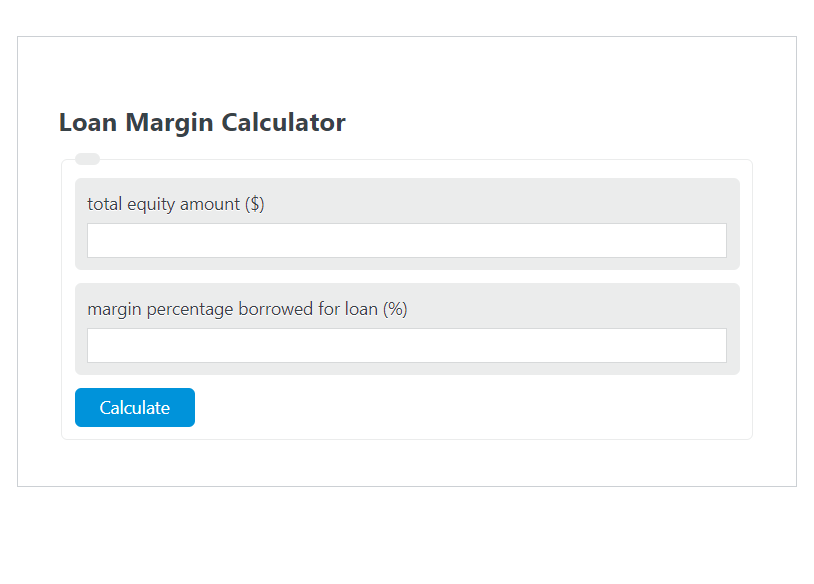

Enter the total equity amount ($) and the margin percentage borrowed for loan (%) into the Loan Margin Calculator. The calculator will evaluate and display the Loan Margin.

Loan Margin Formula

The following formula is used to calculate the Loan Margin.

LM = E * MR/100

- Where LM is the Loan Margin ($)

- E is the total equity amount ($)

- MP is the margin percentage borrowed for loan (%)

How to Calculate Loan Margin?

The following example problems outline how to calculate Loan Margin.

Example Problem #1:

- First, determine the total equity amount ($).

- The total equity amount ($) is given as: 100,000.

- Next, determine the margin percentage borrowed for loan (%).

- The margin percentage borrowed for loan (%) is provided as: 25.

- Finally, calculate the Loan Margin using the equation above:

LM = E * MR/100

The values given above are inserted into the equation below and the solution is calculated:

LM = 100,000 * 25/100 = 25,000.00 ($)

FAQ

What is equity in the context of a loan margin calculator?

Equity refers to the value of an asset after deducting the amount of liabilities or loans against it. In the context of a loan margin calculator, it represents the total value of the collateral or investment that is being used to secure the loan, from which the loan amount is calculated.

How does the margin percentage affect the loan margin?

The margin percentage is a critical factor in determining the loan margin, as it represents the portion of the loan amount relative to the equity’s total value. A higher margin percentage means a higher loan amount can be borrowed against the equity, leading to a higher loan margin. Conversely, a lower margin percentage results in a lower loan margin.

Can the loan margin change over time?

Yes, the loan margin can change over time due to variations in the value of the equity or adjustments in the margin percentage. If the value of the equity increases, the loan margin may also increase if the margin percentage remains constant. Similarly, if the lender adjusts the margin percentage, it can directly impact the loan margin, either increasing or decreasing it based on the direction of the adjustment.