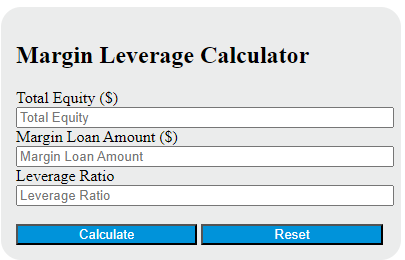

Enter the total equity and margin loan amount into the calculator to determine the leverage ratio. This calculator can also evaluate any of the variables given the others are known.

Margin Leverage Formula

The following formula is used to calculate the margin leverage.

L = (E / (E - M))

Variables:

- L is the leverage ratio

- E is the total equity in the account ($)

- M is the margin loan amount ($)

To calculate the margin leverage, subtract the margin loan amount from the total equity in the account. Then, divide the total equity in the account by the result. The quotient is the leverage ratio.

What is a Margin Leverage?

Margin leverage refers to the practice of using borrowed funds from a broker to trade financial assets, which forms the collateral for the loan from the broker. This strategy allows investors to amplify their buying power and potential returns, but also increases the risk of losses. The leverage ratio is determined by the amount of margin (borrowed money) used in the transaction compared to the investor’s own funds.

How to Calculate Margin Leverage?

The following steps outline how to calculate the Margin Leverage ratio.

- First, determine the total equity in the account ($).

- Next, determine the margin loan amount ($).

- Next, gather the formula from above = L = (E / (E – M)).

- Finally, calculate the Margin Leverage ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total equity in the account ($) = 5000

margin loan amount ($) = 2000