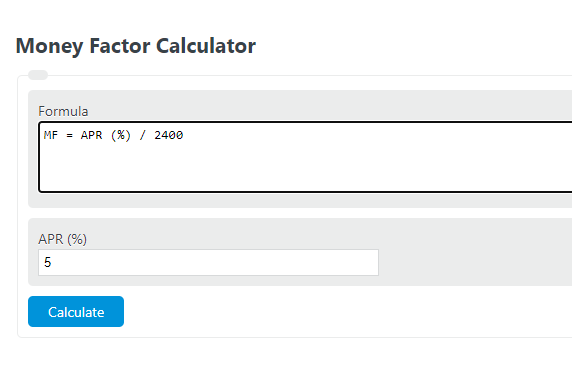

Enter the total annual percentage rate into the calculator to determine the equivalent money factor.

Money Factor Formula

The following formula is used to calculate a money factor.

MF = APR / 2400

- Where MF is the money factor

- APR is the annual percentage rate

Money Factor Definition

Money factor refers to the cost of financing a lease or loan for a vehicle. It is essentially the interest rate applied to the amount being financed. Money factor is important because it directly affects the monthly payment and overall cost of borrowing money for a vehicle.

A lower money factor means lower monthly payments and less interest paid over the life of the lease or loan. It is a crucial factor to consider when negotiating lease or loan terms, as a lower money factor can save a significant amount of money in the long run.

Money Factor Example

How to calculate a money factor/lease factor?

- First, determine the APR.

Calculate the annual percentage rate of the lease or loan.

- Next, calculate the money factor.

Use the equation above to determine the money factor/lease factor.

FAQ

What is the difference between APR and money factor?

APR (Annual Percentage Rate) represents the annualized interest rate charged on a loan or lease, encompassing both the interest rate and any additional fees or costs. Money factor, on the other hand, is specifically used in auto leasing to represent the financing charges you’ll pay on a lease. It’s a decimal number that, when multiplied by 2400, can be compared to an APR.

How can I convert a money factor to an APR?

To convert a money factor to an APR, you multiply the money factor by 2400. This calculation gives you the equivalent annual percentage rate, allowing for easier comparison with traditional loan interest rates.

Why is understanding money factor important when leasing a car?

Understanding the money factor is crucial when leasing a car because it directly impacts your monthly lease payments and the total cost of the lease. A lower money factor means lower financing charges, making the lease more affordable over its term. It’s a key negotiation point when discussing lease terms.

Can I negotiate the money factor on a car lease?

Yes, in many cases, the money factor on a car lease is negotiable. Dealerships often mark up the money factor for profit. By knowing the base money factor (the lowest possible rate you can qualify for), you can negotiate a better deal. It’s important to research and understand your creditworthiness and the going rates before negotiating.