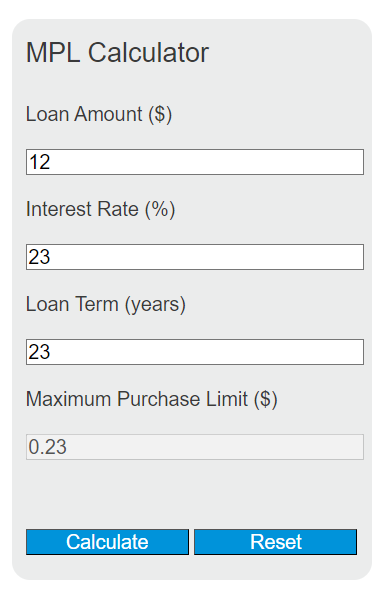

Enter the loan amount, interest rate, and loan term into the calculator to determine the Maximum Purchase Limit (MPL). This calculator helps you understand the maximum property price you can afford based on your loan details.

MPL Formula

The following formula is used to calculate the Maximum Purchase Limit (MPL).

MPL = LA / ((1 - (1 + MR)^{-n}) / MR)Variables:

- MPL is the Maximum Purchase Limit ($)

- LA is the loan amount ($)

- MR is the monthly interest rate (annual interest rate / 12)

- n is the total number of payments (loan term in years * 12)

To calculate the MPL, divide the loan amount by the result of the formula (1 – (1 + monthly interest rate) raised to the power of negative total number of payments) divided by the monthly interest rate.

What is Maximum Purchase Limit (MPL)?

The Maximum Purchase Limit (MPL) is the highest price of a property that a buyer can afford to purchase based on the amount of loan they are eligible for, the interest rate, and the term of the loan. It is a crucial figure for homebuyers to understand their budget constraints when looking for a property. Financial institutions use this calculation to ensure that borrowers do not overextend their financial capabilities.

How to Calculate Maximum Purchase Limit?

The following steps outline how to calculate the Maximum Purchase Limit (MPL).

- First, determine the loan amount (LA) you are eligible for in dollars.

- Next, determine the annual interest rate (IR) of the loan in percentage.

- Convert the annual interest rate to a monthly interest rate (MR) by dividing it by 12.

- Determine the loan term (LT) in years.

- Calculate the total number of payments (n) by multiplying the loan term in years by 12.

- Use the MPL formula to calculate the Maximum Purchase Limit.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Loan Amount (LA) = $250,000

Annual Interest Rate (IR) = 4.5%

Loan Term (LT) = 30 years