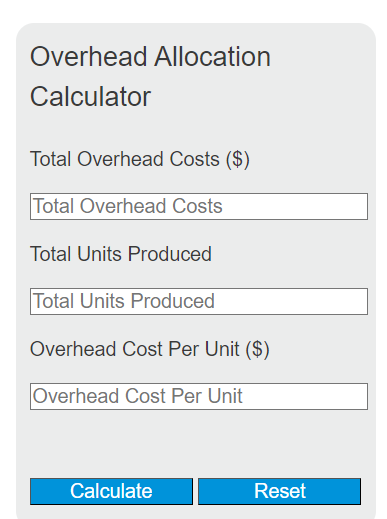

Enter the total overhead costs and the total units produced into the calculator to determine the overhead cost per unit. This calculator helps in allocating overhead costs to each unit of production.

Overhead Allocation Formula

The following formula is used to calculate the overhead cost per unit.

OCP = TO / TU

Variables:

- OCP is the overhead cost per unit ($)

- TO is the total overhead costs ($)

- TU is the total units produced

To calculate the overhead cost per unit, divide the total overhead costs by the total units produced.

What is Overhead Allocation?

Overhead allocation is the process of distributing indirect costs, known as overheads, to specific cost objects like products, services, or departments. These costs are not directly traceable to a product but are necessary for the production process. Examples of overhead costs include rent, utilities, and salaries of administrative staff. Proper overhead allocation is crucial for accurate product costing, pricing decisions, and profitability analysis.

How to Calculate Overhead Cost Per Unit?

The following steps outline how to calculate the Overhead Cost Per Unit.

- First, determine the total overhead costs (TO) in dollars.

- Next, determine the total units produced (TU).

- Next, gather the formula from above = OCP = TO / TU.

- Finally, calculate the Overhead Cost Per Unit (OCP) in dollars.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Total Overhead Costs (TO) = $50,000

Total Units Produced (TU) = 10,000 units