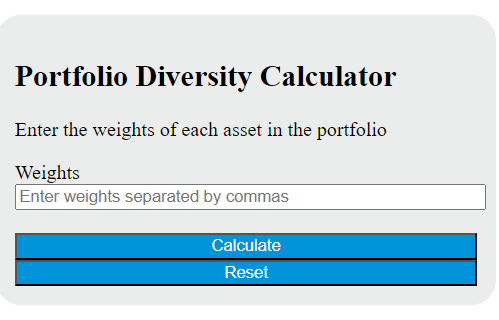

Enter all but one of the weights of the assets in the portfolio into the calculator to determine the portfolio diversity score; this calculator can also evaluate the weight of a specific asset or the total number of assets in the portfolio, given the portfolio diversity score.

Portfolio Diversity Formula

The following formula is used to calculate the portfolio diversity score:

PD = (1 - sum_{i=1}^{n} w_i^2)Variables:

- PD is the portfolio diversity score

- w_i is the weight of the i-th asset in the portfolio

- n is the total number of assets in the portfolio

To calculate the portfolio diversity score, square each weight of the assets in the portfolio, sum up all the squared weights, and subtract the sum from 1. The resulting value represents the portfolio diversity score, with higher values indicating greater diversity.

What is a Portfolio Diversity?

Portfolio diversity, also known as portfolio diversification, is an investment strategy that involves spreading investments across various types of assets, industries, geographic regions, or securities to reduce risk and potential losses. The main idea behind portfolio diversity is not to put all your eggs in one basket. By diversifying, an investor can mitigate the risk of a single investment failing or an entire sector performing poorly. For instance, if an investor has a diversified portfolio consisting of stocks, bonds, real estate, and commodities, a downturn in the stock market may be offset by gains in real estate or commodities. This strategy can help to protect the investor's overall portfolio value and potentially enhance returns over the long term.

How to Calculate Portfolio Diversity?

The following steps outline how to calculate the Portfolio Diversity.

- First, determine the total value of the portfolio ($).

- Next, determine the value of each individual asset class within the portfolio ($).

- Next, calculate the weight of each asset class by dividing its value by the total value of the portfolio.

- Then, calculate the squared weight of each asset class.

- Next, sum up the squared weights of all asset classes.

- Finally, calculate the Portfolio Diversity by subtracting the sum of squared weights from 1.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Total value of the portfolio ($) = 500,000

Value of asset class A ($) = 200,000

Value of asset class B ($) = 150,000

Value of asset class C ($) = 150,000

Value of asset class D ($) = 100,000