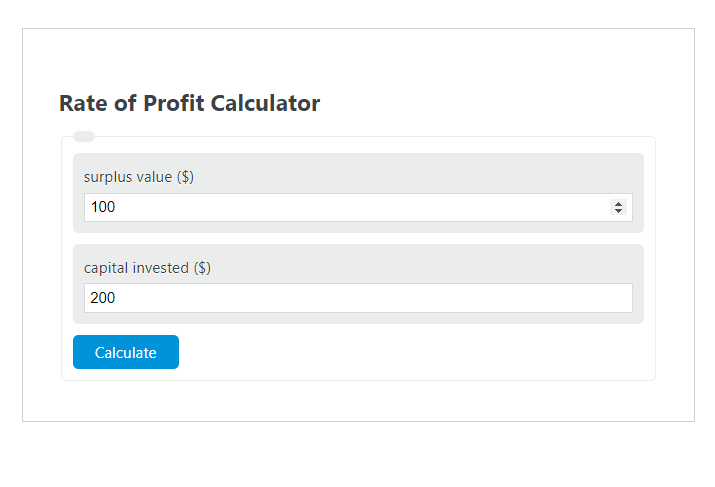

Enter the surplus value ($) and the capital invested ($) into the calculator to determine the Rate of Profit.

- All Profit Calculators

- Bond Profit Calculator

- Daily Profit Calculator

- Fractional Shares Profit Calculator

Rate of Profit Formula

The following formula is used to calculate the Rate of Profit.

ROP = SV / CI

- Where ROP is the Rate of Profit

- SV is the surplus value ($)

- CI is the capital invested ($)

How to Calculate Rate of Profit?

The following example problems outline how to calculate Rate of Profit.

Example Problem #1:

- First, determine the surplus value ($). In this example, the surplus value ($) is given as 1000.

- Next, determine the capital invested ($). For this problem, the capital invested ($) is given as 3000.

- Finally, calculate the Rate of Profit using the equation above:

ROP = SV / CI

The values given above are inserted into the equation below:

ROP = 1000 / 3000 = .33

FAQ

What is surplus value in the context of calculating the Rate of Profit?

Surplus value refers to the additional value created in the production process, which is above and beyond the cost of capital invested. It represents the profit generated from the investment before any deductions or expenses are taken into account.

How can understanding the Rate of Profit help in business decision-making?

Understanding the Rate of Profit can help businesses in decision-making by providing insights into the efficiency and profitability of investments. It allows businesses to compare the profitability of different investments or projects, helping to allocate resources more effectively and strategically plan for growth.

Is the Rate of Profit the only metric to consider when evaluating an investment?

No, the Rate of Profit is an important metric, but it’s not the only one to consider when evaluating an investment. Other financial metrics such as Return on Investment (ROI), Net Profit Margin, and Cash Flow are also crucial for a comprehensive analysis. Each metric offers different insights, and together they provide a fuller picture of an investment’s performance.