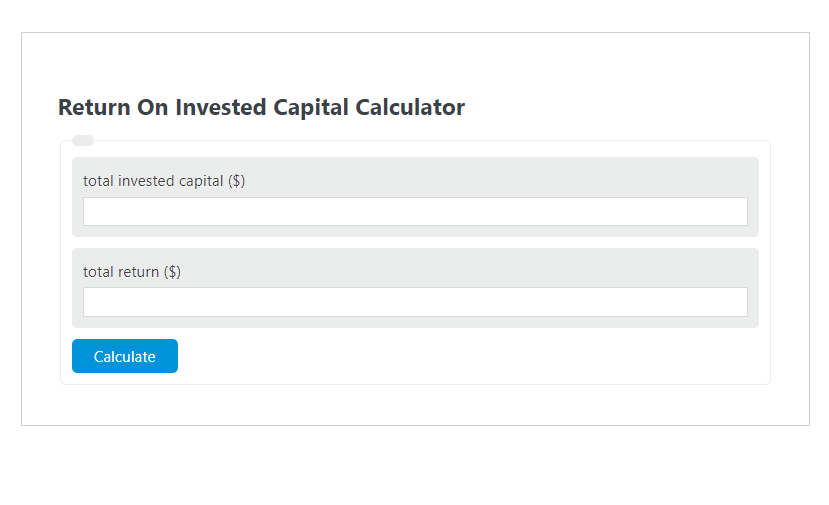

Enter the total invested capital ($) and the total return ($) into the Return on Invested Capital Calculator. The calculator will evaluate and display the Return on Invested Capital.

- Return on “X” Calculators

- Average Return on Investment Calculator

- Return on Mutual Fund Calculator

- Return on Sales Calculator

Return on Invested Capital Formula

The following formula is used to calculate the Return on Invested Capital.

ROIC = R / IC * 100

- Where ROIC is the Return on Invested Capital (%)

- R is the total invested capital ($)

- IC is the total return ($)

To calculate the return on invested capital, divide the total return by the total invested amount, then multiply by 100.

How to Calculate Return on Invested Capital?

The following example problems outline how to calculate Return on Invested Capital.

Example Problem #1:

- First, determine the total invested capital ($).

- The total invested capital ($) is given as: 350.

- Next, determine the total return ($).

- The total return ($) is provided as: 1000.

- Finally, calculate the Return on Invested Capital using the equation above:

ROIC = R / IC * 100

The values given above are inserted into the equation below and the solution is calculated:

ROIC = 350 / 1000 * 100 = 35 (%)

FAQ

What is Return on Invested Capital (ROIC) and why is it important?

ROIC is a profitability ratio that measures how effectively a company uses its capital to generate profits. It is important because it provides investors with insight into how well a company is allocating its financial resources to generate returns.

How can ROIC help in investment decisions?

ROIC can help investors assess the efficiency of a company’s capital investments. A higher ROIC indicates that a company is generating more profit per dollar of invested capital, which can be a sign of a good investment opportunity.

Can ROIC be used to compare companies in different industries?

Yes, ROIC can be used to compare companies across different industries as it reflects the efficiency of capital use irrespective of the industry. However, it’s important to consider industry-specific factors and benchmarks when making such comparisons.