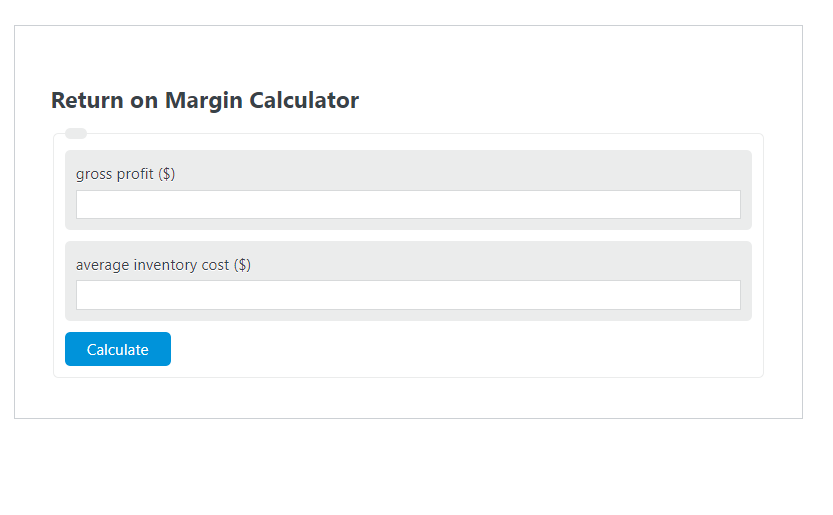

Enter the gross profit ($) and the average inventory cost ($) into the Return on Margin Calculator. The calculator will evaluate and display the Return on Margin.

- Return on “X” Calculators

- Return on Stocks Calculator

- Return on Rent Calculator

- Return on Inventory Calculator

Return on Margin Formula

The following formula is used to calculate the Return on Margin.

ROM = GP / AIC *100

- Where ROM is the Return on Margin (%)

- GP is the gross profit ($)

- AIC is the average inventory cost ($)

To calculate the return on margin, divide the gross profit by the average inventory cost, then multiply by 100.

How to Calculate Return on Margin?

The following example problems outline how to calculate Return on Margin.

Example Problem #1:

- First, determine the gross profit ($).

- The gross profit ($) is given as: 68.

- Next, determine the average inventory cost ($).

- The average inventory cost ($) is provided as: 175.

- Finally, calculate the Return on Margin using the equation above:

ROM = GP / AIC *100

The values given above are inserted into the equation below and the solution is calculated:

ROM = 68 / 175 *100 = 38.85 (%)

FAQ

What is gross profit and how is it calculated?

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. It is calculated by subtracting the cost of goods sold (COGS) from the total revenue.

Why is average inventory cost important in calculating Return on Margin?

The average inventory cost is important because it represents the total cost of goods available for sale during a specific period, averaged out. It is a critical factor in calculating the Return on Margin as it directly impacts the gross profit, thereby affecting the ROM value. Understanding the average inventory cost helps businesses manage their inventory more efficiently, ensuring that they are not overstocked or understocked, which can affect profitability.

Can Return on Margin be used to assess the performance of any type of investment?

While Return on Margin is particularly useful for evaluating the profitability and efficiency of selling inventory, it is not universally applicable to all types of investments. ROM is most relevant to businesses that have inventory as a significant part of their operations, such as retail or manufacturing. For other types of investments, such as stocks or real estate, other metrics like Return on Investment (ROI) or Return on Equity (ROE) might be more appropriate.