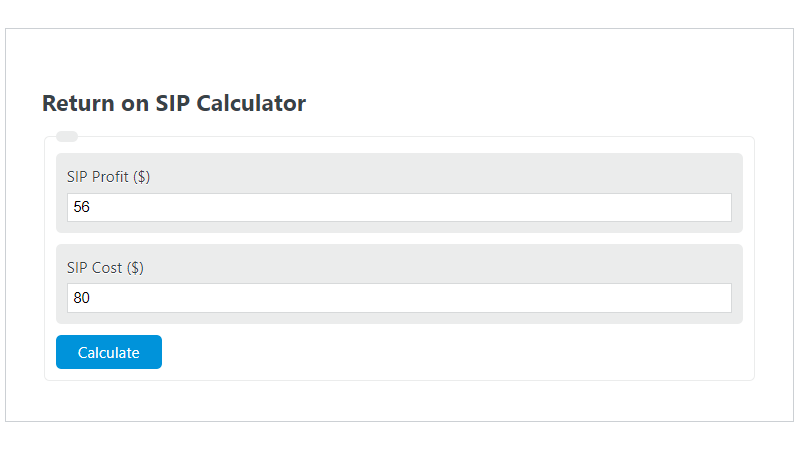

Enter the SIP Profit ($) and the SIP Cost ($) into the Return on SIP Calculator. The calculator will evaluate and display the Return on SIP.

- Return on “X” Calculators

- Return on Innovation Calculator

- Return on Quality Calculator

- Return on T-Bills Calculator

Return on SIP Formula

The following formula is used to calculate the Return on SIP.

ROSIP = SP / SC * 100

- Where ROSIP is the Return on SIP (%)

- SP is the SIP Profit ($)

- SC is the SIP Cost ($)

How to Calculate Return on SIP?

The following example problems outline how to calculate Return on SIP.

Example Problem #1:

- First, determine the SIP Profit ($).

- The SIP Profit ($) is given as: 1500.

- Next, determine the SIP Cost ($).

- The SIP Cost ($) is provided as: 2000.

- Finally, calculate the Return on SIP using the equation above:

ROSIP = SP / SC * 100

The values given above are inserted into the equation below and the solution is calculated:

ROSIP = 1500 / 2000 * 100 = 75.00 (%)

FAQ

What is SIP in the context of Return on SIP?

SIP stands for Systematic Investment Plan, which is a method of investing a fixed sum regularly in mutual funds. In the context of Return on SIP, it refers to the profit or loss generated from such an investment plan compared to the initial cost.

How can the Return on SIP formula help investors?

The Return on SIP formula helps investors understand the efficiency and profitability of their investments in SIPs. By calculating the percentage return, investors can assess the performance of their SIP investments over time and make informed decisions about continuing, adjusting, or exiting their investment plans.

Can the Return on SIP formula be used for investments other than SIPs?

While the formula is specifically designed for calculating the return on SIP investments, the concept can be adapted for other types of investments where there is a clear profit and cost figure. However, for other investment types, additional factors might need to be considered, and the formula may require adjustments to accurately reflect the return on investment.