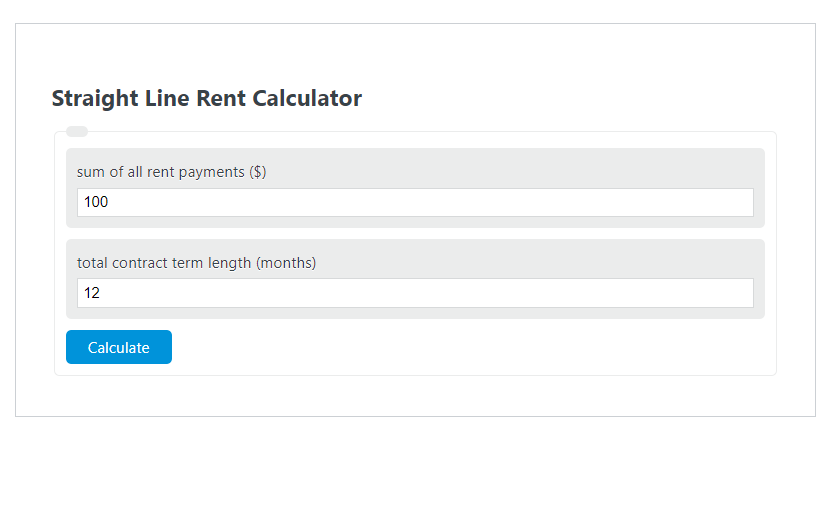

Enter the sum of all rent payments ($) and the total contract term length (months) into the calculator to determine the Straight Line Rent.

- All Rent Calculators

- Late Rent Calculator

- Potential Rent Calculator

- Annual Rent Calculator

- RPI Ground Rent Calculator

- Fortnightly (Bi-Monthly) Rent Calculator

Straight Line Rent Formula

The following formula is used to calculate the Straight Line Rent.

Rsl = SRP / CL

- Where Rsl is the Straight Line Rent ($/month)

- SRP is the sum of all rent payments ($)

- CL is the total contract term length (months)

To calculate the straight line rent, divide the sum of all rent payments by the total contract term length.

How to Calculate Straight-Line Rent?

The following example problems outline how to calculate Straight Line Rent.

Example Problem #1:

- First, determine the sum of all rent payments ($). In this example, the sum of all rent payments ($) is given as 20000.

- Next, determine the total contract term length (months). For this problem, the total contract term length (months) is given as 10.

- Finally, calculate the Straight Line Rent using the equation above:

Rsl = SRP / CL

The values given above are inserted into the equation below:

Rsl = 20000 / 10 = 2000 ($/month)

FAQ

What is Straight Line Rent?

Straight Line Rent is an accounting method used to evenly distribute the total amount of rent payments over the term of the lease. This method calculates the average monthly rent payment, regardless of any fluctuations or changes in the actual rent payments over the lease term.

Why is Straight Line Rent important in accounting?

Straight Line Rent is important in accounting because it provides a consistent method for recognizing rent expenses and liabilities over the term of a lease. This consistency is crucial for accurate financial reporting and analysis, helping businesses to better predict their future financial obligations and performance.

Can Straight Line Rent be used for any type of lease?

Straight Line Rent is most commonly used in commercial real estate leases where the rent payments may vary over the term of the lease. However, it can be applied to any lease agreement that allows for rent variations, including step-up leases, rent holidays, or leases with escalating rent payments. It is important to consult with an accounting professional to ensure it is applied correctly according to relevant accounting standards.