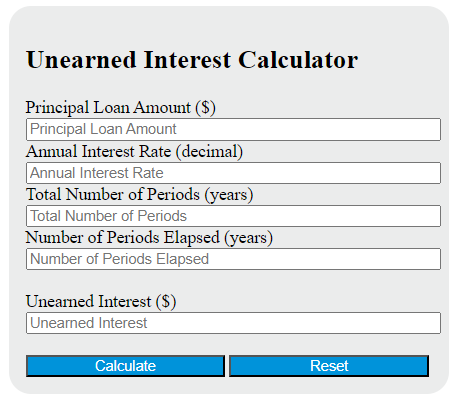

Enter the principal loan amount, annual interest rate, number of periods, and time elapsed into the calculator to determine the unearned interest.

- Statutory Interest Calculator

- Money Factor to Interest Rate Calculator

- Time Interest Earned Ratio Calculator

Unearned Interest Formula

The following formula is used to calculate the unearned interest.

UI = P * r * (n - t)

Variables:

- UI is the unearned interest ($)

- P is the principal loan amount ($)

- r is the annual interest rate (decimal)

- n is the total number of periods (years)

- t is the number of periods elapsed (years)

To calculate the unearned interest, multiply the principal loan amount by the annual interest rate, then multiply the result by the difference between the total number of periods and the number of periods elapsed.

What is a Unearned Interest?

Unearned interest refers to the portion of a loan that has been given out but the interest on it has not yet been earned by the lender. This usually applies to loans where the interest is calculated and added to the total loan amount at the beginning of the loan period. Until the borrower makes payments, the interest portion of the loan is considered unearned by the lender. It is essentially the interest income that the lender expects to receive in the future as the loan is paid off.

How to Calculate Unearned Interest?

The following steps outline how to calculate the Unearned Interest using the given formula:

- First, determine the principal loan amount ($).

- Next, determine the annual interest rate (decimal).

- Next, determine the total number of periods (years).

- Next, determine the number of periods elapsed (years).

- Next, gather the formula from above = UI = P * r * (n – t).

- Finally, calculate the Unearned Interest.

- After inserting the variables and calculating the result, check your answer with a calculator.

Example Problem:

Use the following variables as an example problem to test your knowledge:

Principal loan amount ($) = 5000

Annual interest rate (decimal) = 0.05

Total number of periods (years) = 3

Number of periods elapsed (years) = 1