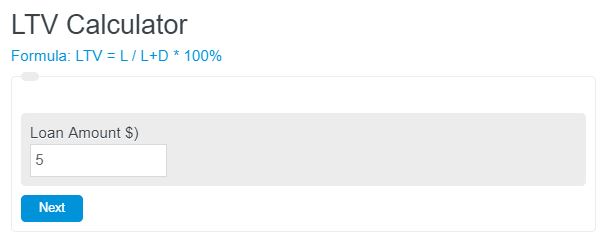

Enter the purchase price and down payment of a loan into the LTV Calculator. The LTV Calculator will display the LTV % and loan amount.

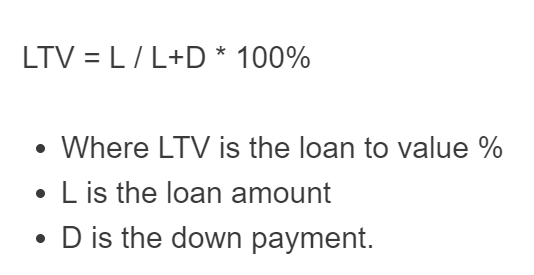

LTV Formula

The following formula is used to calculate the LTV Ratio.

LTV = L / V *100

- Where LTV is the loan-to-value %

- L is the loan amount

- V is the current value

LTV (Loan-to-Value) Definition

Loan-to-Value (LTV) is a financial ratio that compares the amount of a loan to the appraised value of an asset, typically a property. It is calculated by dividing the loan amount by the appraised value and multiplying it by 100 to express it as a percentage. LTV is important because it helps lenders assess the risk associated with a loan.

A lower LTV indicates that the borrower has more equity in the asset, which means they have a greater financial stake in the property. This makes them less likely to default on the loan since they have more to lose. Consequently, lenders generally prefer lower LTV ratios to reduce risk exposure.

LTV also plays a crucial role in determining the interest rate and terms of a loan. Higher LTV ratios indicate a higher risk for lenders, leading to higher interest rates or additional requirements such as private mortgage insurance. On the other hand, a lower LTV may result in more favorable loan terms, including lower interest rates and potentially higher loan amounts.

How to calculate LTV?

How to calculate LTV?

- Determine the original loan amount

This will be the original purchase price of the item you wish to buy. For example, if a house costs 500,000 dollars the loan amount would also need to be $500,000.00.

- Determine your desired down payment

This will be the amount of money you wish to put “down” on the loan. In essence, this amount will get subtracted from the loan. For mortgages, a minimum of 10% is recommended.

- Calculate the LTV

Enter the purchase price and down payment into the formula to calculate the loan to value %.

FAQ

LTV stands for loan to value. It is a ratio of the amount of a loan to the actual price of a good. For example, if a house costs 5$ and a down payment of 1$ is made, the LTV would be 80%.

That depends on what is being purchased. The lower the LTV the less the loan is compared to the purchase price. This will lead to less interest paid over time.