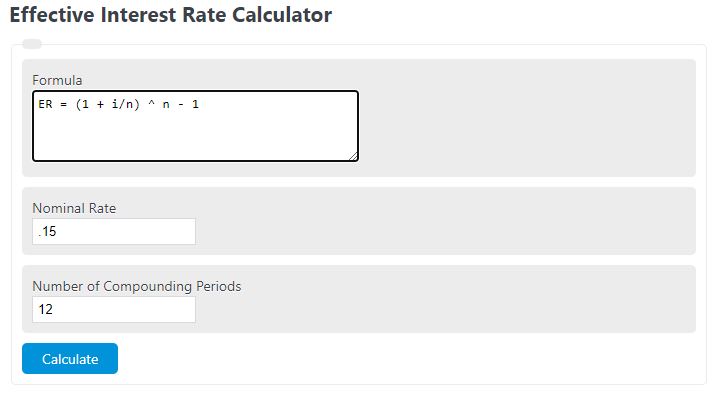

Enter the annual nominal rate and the number of compounding periods per year into the calculator to determine the effective interest rate.

- Real Interest Rate Calculator

- Real Return Calculator

- Daily Interest Calculator

- Imputed Interest Calculator

- Reverse Interest Calculator

- Auto Loan Per Diem Calculator

Effective Interest Rate Formula

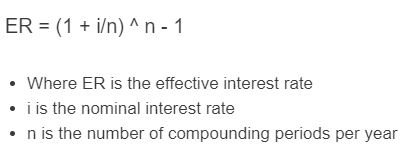

The following formula is used to calculate an effective interest rate.

ER = (1 + i/n) ^ n - 1

- Where ER is the effective interest rate

- i is the nominal interest rate

- n is the number of compounding periods per year

Effective Interest Rate Definition

The Effective Interest Rate (EIR) is a financial metric that measures the true cost of borrowing or the return on investment over a specified period.

It is derived by accounting for interest compounding within a given time frame. Rather than solely considering the nominal interest rate, the EIR reflects the actual interest earned or paid, including any additional fees or charges.

Effective Interest Rate Example

How to calculate an effective interest rate.

- First, determine the nominal rate.

For this example, we will say we are looking at a credit card with a monthly nominal rate of .15 (15%).

- Next, determine the compounding periods per year.

Since the nominal rate is per month, the compounding period is 12 months per year.

- Finally, calculate the effective interest rate.

Using the formula above we find the effective rate to be (1+.15/12)^12 – 1 = .1607

FAQ

How does compounding affect the effective interest rate?

Compounding increases the effective interest rate because interest is earned on previously accumulated interest in addition to the principal amount. The more frequently interest is compounded, the higher the effective interest rate will be.

Why is the effective interest rate important?

The effective interest rate provides a more accurate measure of the cost of borrowing or the return on investment. It takes into account the effects of compounding, offering a clearer picture of the financial impact than the nominal rate alone.

Can the effective interest rate be lower than the nominal rate?

No, the effective interest rate is always equal to or higher than the nominal rate due to the compounding of interest. The only scenario where they might be equal is if interest is compounded once per year or not at all.

How can I lower the effective interest rate on a loan?

To lower the effective interest rate, you can choose a loan with fewer compounding periods, make more frequent payments to reduce the principal faster, or negotiate a lower nominal interest rate with the lender.