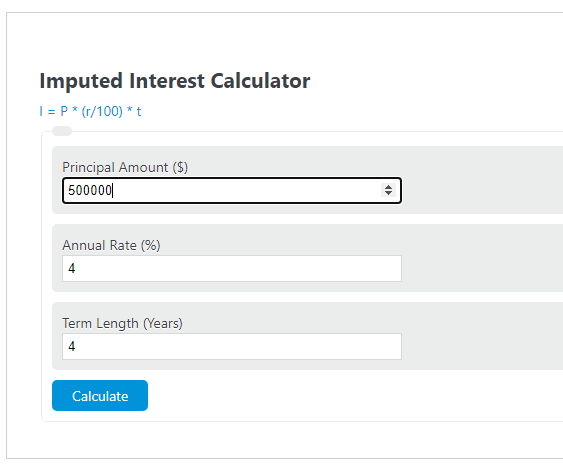

Enter the principal amount, minimum interest rate or return, and the number of years into the calculator to determine the imputed interest rate.

- Capitalized Interest Calculator

- Cash Advance Interest Calculator

- Effective Interest Rate Calculator

- Zero Coupon Bond Calculator

- Reverse Interest Calculator

- Money Factor to Interest Rate Calculator

Imputed Interest Formula

The following formula is used to calculate the imputed interest rate of a zero-coupon bond or below-market loan.

I = P * (r/100) * t

- Where I is the imputed interest ($)

- P is the principal amount ($)

- r is the minimum interest rate (%)

- t is the number of years of the loan or bond

To calculate imputed interest, multiply the principal by the rate, then multiply again by the number of years.

Imputed Interest Definition

Imputed interest is defined as the total interest amount that a lender estimates it will collect on a loan or bond, without regard to the amount that the lender would receive.

Example Problem

How to calculate imputed interest?

The first step to calculating an imputed interest amount is to determine the principal balance of the loan or bond.

For this example problem, the imputed interest is determined to be $500,000.00.

The next step in determining the imputed interest is to determine the minimum interest rate or expected return rate on an annual basis.

In this case, the annual interest rate is found to be 4%.

Next, the number of years the loan is taken out must be determined. In most cases, this is a number of years, but there are situations where a monthly rate and term are used.

In this example, the number of years is found to be 4 years.

Finally, using the formula I = P * (r/100) * t

I = 500,000*(4/100)*4 = $80,000.00.