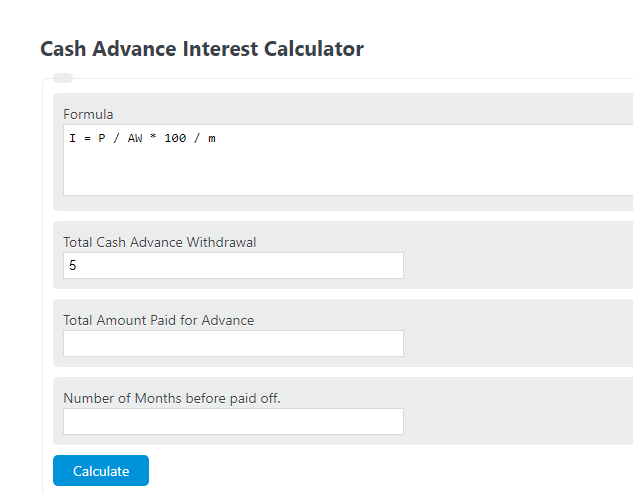

Enter the desired withdrawal amount, the number of periods (months), and the final charge or amount paid for the cash advance to calculator the cash advance interest rate.

Cash Advance Interest Formula

The following equation is used to calculate a cash advance interest rate.

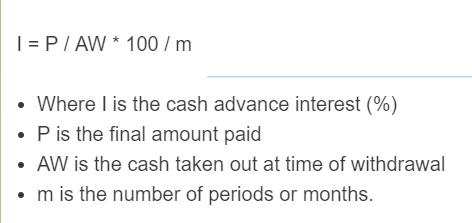

I = P / AW * 100 / m

- Where I is the cash advance interest (%)

- P is the final amount paid.

- AW is the cash taken out at the time of withdrawal.

- m is the number of periods or months.

The variable m represents the number of periods or months.

AW refers to the amount of money that is physically obtained at the moment of making a withdrawal from a bank account or financial institution.

P is the total sum of money that is ultimately paid or owed.

Cash Advance Interest Definition

Cash advance interest refers to the interest charged on a cash advance taken from a credit card. When a cardholder withdraws cash from an ATM using their credit card, the credit card issuer typically charges a higher interest rate on that amount compared to the interest rate for regular credit card purchases. This is because cash advances are considered riskier for the credit card issuer, as they are not backed by any collateral and are seen as a form of borrowing money.

The cash advance interest rate is usually higher than the regular purchase interest rate and can vary depending on the credit card issuer and the terms of the card agreement. In addition to the higher interest rate, cash advances may also be subject to additional fees, such as a cash advance fee or ATM withdrawal fee. It is important for cardholders to carefully read and understand their credit card agreement to be aware of the specific terms and conditions regarding cash advances and the associated interest rates and fees.

Cash Advance Interest Example

How to calculate cash advance interest?

- First, determine the initial withdrawal.

Determine how much cash was initially withdrawn or taken out as credit.

- Next, determine the total number of periods.

Determine the number of months before the credit or cash advance is paid off.

- Next, determine the total amount paid.

Calculate the final amount paid for the cash advance.

- Finally, calculate the cash advance interest.

Calculate the interest using the equation above.

FAQ

What are the typical fees associated with a cash advance?In addition to a higher interest rate, cash advances often come with additional fees such as cash advance fees, which are either a flat rate or a percentage of the withdrawal amount, and ATM withdrawal fees if the cash is obtained from an ATM.

How does the interest rate for cash advances compare to regular purchase interest rates?The interest rate for cash advances is typically higher than the interest rate for regular credit card purchases. This is because cash advances are considered riskier by credit card issuers, as they are immediate loans that are not backed by any collateral.

Why are cash advances considered riskier for credit card issuers?Cash advances are considered riskier because they are immediate, unsecured loans. Unlike purchases, which could potentially be returned for a refund, cash advances are instant cash with no collateral, increasing the risk of non-repayment for the issuer.

Can the cash advance interest rate vary between different credit cards or issuers?Yes, the cash advance interest rate can vary significantly between different credit cards and issuers. It is important for cardholders to review their credit card agreement or contact their issuer to understand the specific rates and fees associated with cash advances on their cards.