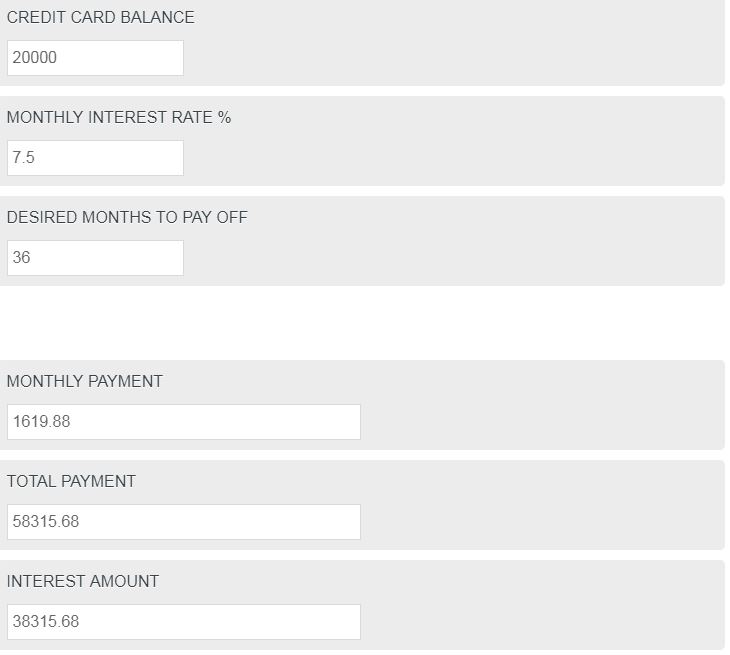

Calculate the monthly payments on your credit card in order to pay off the balance in your desired time frame. Enter the total balance, monthly interest rate (yearly interest rate/12), and the desired pay-off time.

- Effective Interest Rate Calculator

- Real Interest Rate Calculator

- Forward Rate Calculator

- Unpaid Balance Calculator

- Processing Fees Calculator

- Chargeback Threshold Ratio Calculator

Credit Card Formula

The following formula is used to calculate the interest owed on a credit card.

I = B * APR/12/100

- Where I is the monthly interest

- B is the balance on the card

- APR is the annual interest rate (%)

To calculate the credit card interest, multiply the balance by the annual interest rate (%), then divide by 1200.

Credit Card Definition

Credit cards typically, if not always, come with an interest rate, which is the premium you pay for “borrowing” money from the lender.

For credit cards, this interest rate is normally expressed at a yearly rate. This is also known as the annual percentage (APR). With that said, typically, this annual rate is divided by 12 months and applied to your credit card bill every month.

In short, this is how interest is calculated on your credit card, for example. If you owe $400.00 on a credit card and your APR is 12% (FYI, that’s way lower than normal), then you will pay $40.00 in interest for the month this is not paid off.

Credit Card Calculator Payoff

Paying off a credit card is one of the top 10 stresses in people’s lives, according to a recent study. Because of this, it’s important to understand the correct way to pay for credit cards.

Method 1) Pay the entire balance of the credit card every single month on time. This is the only true way to avoid interest payments and build a very good credit score. With that said, it’s not always the most feasible for people with variable incomes.

Method 2) Pay the maximum amount you can afford each month. This will reduce the total interest you end up paying while also allowing you to pay for other things in life.

Method 3) Pay the minimum balance on the credit card. This is not advised and will cause you to accrue an extremely large amount of interest. Never use this method unless you have to.

Credit Card Calculator Payment