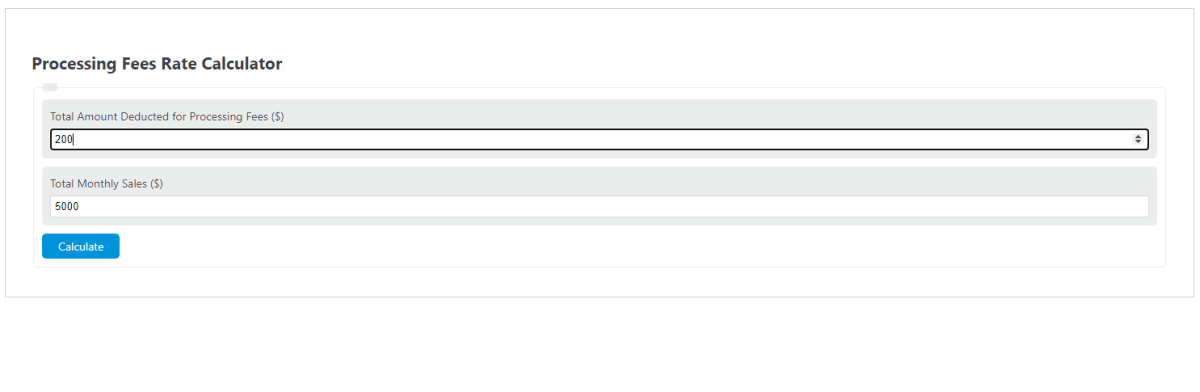

Enter the total deducted for processing and the total monthly sales into the calculator to determine the effective credit card processing rate.

- Consulting Fees Calculator

- Credit Card Calculator

- Amounts Generally Billed (AGB) Calculator

- Chargeback Threshold Ratio Calculator

- Transaction Cost Calculator

- Average Transaction Value Calculator

Processing Fees Formula

The following formula is used to calculate a credit card effective processing rate:

EFF = PF / MS * 100

- Where EFF is the effective credit card processing rate (%)

- PF is the total amount of processing fees per month ($)

- MS is the total amount of monthly sales ($)

To calculate processing fees rate, divide the total amount of processing fees per month by the total monthly sales, then multiply by 100.

What are processing fees?

Processing fees are monetary collections made by credit card companies on every sale a business makes and is paid for by credit card.

The processing fees are said to be charged because of the convenience the credit cards provide and the subsequent cost for the companies to maintain their financial credit card network.

This is up for debate/interpretation.

How to calculate an effective credit card processing fees rate?

Example Problem:

The following example outlines the necessary steps required to calculate the effective credit card processing fees rate.

First, determine the total amount of money deducted for processing fees in an entire month. In this example, the company in question was charged a total of $500 dollars in processing fees.

Next, determine the total monthly sales for the same period. In this case, the total monthly sales are found to be $4,000.00.

Finally, calculate the effective credit card processing fees rate using the formula above:

EFF% = PF / MS * 100

EFF% = 500 / 4000 * 100

EFF% = 12.5%

The credit card is effectively charging 12.5 percent on all sales the company makes.