Calculate the real interest rate from the nominal interest rate and expected inflation rate by using the Fisher equation. Real interest rates account for inflation.

- Effective Interest Rate Calculator

- Net Interest Margin Calculator

- Interest Coverage Ratio Calculator

- Inflation Premium Calculator

Real Interest Rate Formula

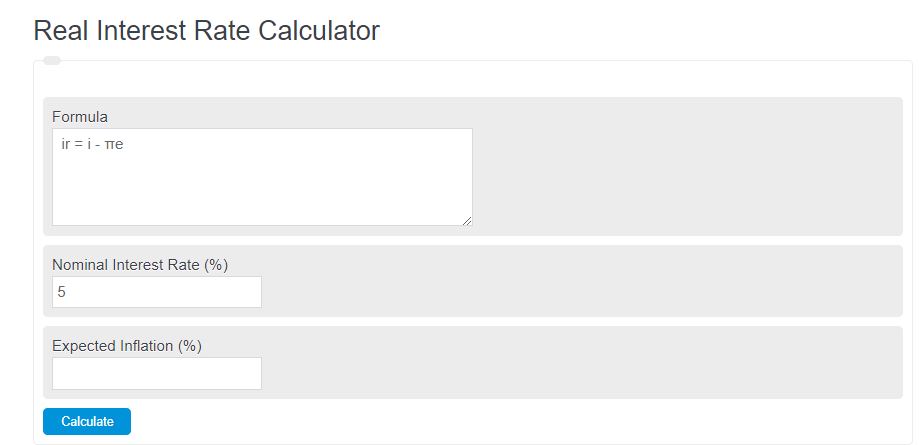

The following formula is used to calculate the real interest rate.

ir = i - e

- Where ir is the real interest rate

- i is the nominal interest rate

- e is the expected rate of inflation.

To calculate the real interest rate, subtract the expected rate of inflation from the nominal interest rate.

Real Interest Rate Definition

The real interest rate is a crucial economic indicator that reflects the true return on investment or borrowing after accounting for inflation. It measures the purchasing power gained or lost from lending or borrowing money.

For borrowers, the real interest rate determines the actual cost of borrowing money. If borrowing at a nominal interest rate of 8% while inflation is 3%, the real interest rate would be 5%. This means borrowers effectively pay 5% in real terms to access funds.

Investors, on the other hand, use the real interest rate to evaluate potential returns on investments. If an investment yields a nominal return of 10% and inflation is at 3%, the real interest rate would be 7%. This signifies the actual increase in purchasing power gained from the investment.

How to calculate real interest rate?

Let’s look at an example of applying the formula above. Let’s say you take out a loan with 7% interest. Next, the expected level of inflation is 2%. Now plug those values into the calculator or equation above, and you have an adjusted real rate of 5%.

As you can tell, the real interest rate is lower than the nominal interest rate. As a result, this means that the money you borrowed will be worthless at the end of the year, and so you will be paying more.

FAQ

What is the difference between nominal and real interest rates?

Nominal interest rates refer to the rate of interest before adjusting for inflation, while real interest rates are the nominal rates adjusted for inflation. The real interest rate more accurately reflects the true cost of borrowing and the real yield on investments.

Why is the real interest rate important?

The real interest rate is important because it provides a clearer picture of the economic landscape. For borrowers, it indicates the true cost of borrowing money, while for investors, it shows the real yield on investments. It helps in making more informed financial decisions.

How does inflation affect the real interest rate?

Inflation reduces the purchasing power of money over time. When the nominal interest rate is adjusted for inflation, the real interest rate is obtained. If inflation increases, the real interest rate decreases, assuming the nominal rate remains constant, and vice versa.

Can the real interest rate be negative?

Yes, the real interest rate can be negative. This happens when the rate of inflation is higher than the nominal interest rate. In such a scenario, the purchasing power of the money returned is less than the purchasing power of the money originally lent or invested.