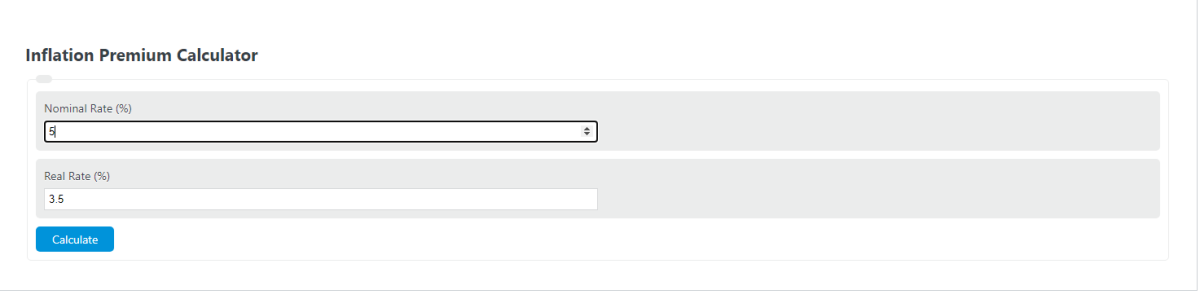

Enter the nominal rate and the real rate between bonds to calculate the inflation premium.

- Risk Premium Calculator

- Default Risk Premium Calculator

- Risk Difference Calculator

- Yield Maintenance Calculator

- Index Cost of Acquisition Calculator

- Real Wage Rate Calculator

Inflation Premium Formula

The following formula is used to calculate the inflation premium between a treasury bond and inflation-protected security.

IP = Yb - Yips

- Where IP is the inflation premium (%)

- Yb is the yield on a treasury bond (%)

- Yips is the yield on an treasury inflation-protected security (%)

To calculate an inflation premium, subtract the return on an inflation protected security from the yield on a treasury bond.

A key component of the formula above is both the treasury bond and the inflation-protected security must have the same coupon rate, redemption value, maturity, and so on.

If the nominal and real rates of return are known, the inflation premium can be calculated using the following formula:

IP = (1+NR) / (1+RR) – 1

- Where NR is the nominal rate

- RR is the real rate

What is an inflation premium?

An inflation premium is a minimum amount of required return that an investor seeks in order to compensate for inflation risk. It’s an additional amount of rate or yield that is needed to account for the decrease in purchasing power of money as time goes on.

In simpler terms, it’s the difference between the yield on a Treasury bond and the yield on a Treasury inflation-protected security.

Example Problem

How to calculate an inflation premium?

First, determine the nominal rate of return of the security. For this example, the nominal rate is 5%.

Next, determine the real rate of return. This is considered the rate of return while taking into account inflation. In this case, the real return is 3.5%.

Finally, calculate the inflation premium using the formula above:

IP = (1+NR) / (1+RR) – 1

IP = ((1+.05) / (1+.035)) – 1

IP = .01449 = 1.449%