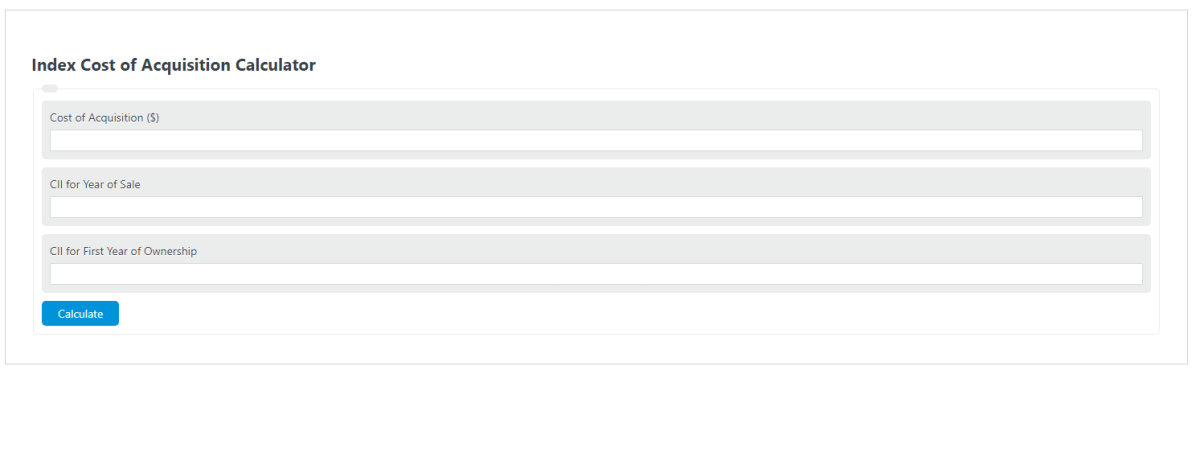

Enter the CII for the year of sales, the CII for the first year the asset is held by the assessee, and the cost of acquisition into the calculator to determine the index cost of acquisition.

- Inflation Premium Calculator

- Variance Inflation Factor Calculator

- Salary Inflation Calculator

- Consumer Price Index (CPI) Calculator

Index Cost of Acquisition Formula

The following formula is used to calculate the indexed cost of acquisition.

ICOA = CII(yot) * COA / CII(fy)

- Where ICOA is the index cost of acquisition

- CII(yot) is the cost inflation index for the year of sale

- CII(fy) is the cost inflation idex for the first year the asset is held by the assessee

- COA is the cost of the acquisition ($)

What is an indexed cost of acquisition?

Indexed cost of acquisition is a concept used to determine the value of an asset after adjusting it for inflation. It is a method of accounting for the impact of inflation on the cost of acquiring an asset over time.

When an asset is acquired, its cost is typically recorded in monetary terms at purchase. However, the value of money changes over time due to inflation. Inflation causes the purchasing power of money to decrease, meaning that the same amount of money will buy less in the future.

The indexed cost of acquisition is calculated by applying an inflation index to the original cost of the asset. This index represents the general increase in prices due to inflation. By multiplying the original cost by this index, the indexed cost of acquisition is determined.

How to calculate the indexed cost of acquisition?

Example Problem:

The following example problem explains the steps and information needed to calculate the indexed cost of acquisition.

First, determine the absolute cost of acquisition. In this case, the asset is purchased at $40,000.00.

Next, determine the cost inflation index for the year of sale. In this example, the CII of the year of sale is found to be 2%.

Next, determine the cost inflation index for the first year the asset is held. For this problem, the CII for the first year is 1.5%.

Finally, calculate the indexed cost of acquisition using the formula above:

ICOA = CII(yot) * COA / CII(fy)

ICOA = 2 * 40,000 / 1.5

ICOA = $53,333.33

FAQ

What is the Cost Inflation Index (CII) and how is it determined?

The Cost Inflation Index (CII) is a measure used by tax authorities to account for inflation when calculating the long-term capital gains on the sale of assets. It is determined by the government and reflects the annual inflation rate. The CII is used to adjust the purchase price of assets to reflect inflation, thereby reducing the taxable gain when the asset is sold.

Why is the indexed cost of acquisition important for taxpayers?

The indexed cost of acquisition is crucial for taxpayers because it allows for the adjustment of the cost of an asset for inflation over the period it was held. This adjusted cost is then used to calculate capital gains or losses, potentially reducing the tax liability on the sale of the asset. It ensures that taxpayers are not unfairly taxed on inflation-driven ‘gains’ that do not represent a real increase in wealth.

Can the indexed cost of acquisition apply to all types of assets?

Generally, the indexed cost of acquisition applies to capital assets such as real estate, stocks, and bonds, which are held for a long term. However, there are exceptions and specific rules depending on the jurisdiction and the type of asset. For example, certain assets like gold and debt mutual funds are eligible for indexation benefits, while others like equity shares held for more than a year may not be, depending on the tax laws of the country. It’s important to consult tax regulations or a tax professional to understand which assets qualify for indexation benefits.