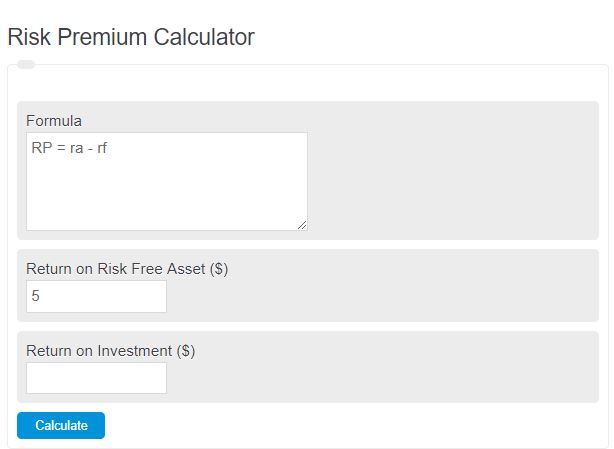

Calculate the risk premium of your investments. Enter the returns of both your risk-free asset and your investment return.

- Earnings Per Share Calculator

- Deadweight Loss Calculator

- Risk-Adjusted Return Calculator

- Treynor Ratio Calculator

Risk Premium Formula

The following formula is used to calculate a risk premium.

RP = RF-RA

- Where Ra is the return on a risk-free asset

- RF is the return on actual investment

To calculate the risk premium, subtract the risk-free return from the actual return.

Risk Premium Definition

A risk premium is the difference in returns between a risk-free asset and another asset class or individual asset.

How to calculate Risk Premium?

How to calculate risk premium?

- First, determine the return of your asset class.

Measure the percentage return of the asset being analyzed.

- Next, determine the return of a risk free asset.

For example a savings account that yields 1% is the

- Finally calculate the risk premium.

Using the formula and returns determined in steps 1 and 2, calculate the risk premium.

FAQ

What factors influence the risk premium of an investment?

The risk premium of an investment is influenced by several factors including the volatility of the investment, the economic environment, investor risk aversion levels, and the time horizon of the investment. Higher volatility and longer investment periods typically result in a higher risk premium.

How does the risk-free rate affect the calculation of risk premium?

The risk-free rate is a critical component in the calculation of risk premium as it represents the return on an investment with no risk. It serves as a benchmark for measuring the additional return required for taking on risk. A higher risk-free rate generally decreases the risk premium, whereas a lower risk-free rate increases it.

Can the risk premium be negative?

Yes, the risk premium can be negative. This occurs when the return on the risky asset is less than the return on the risk-free asset. A negative risk premium indicates that the risky asset underperformed relative to the risk-free asset, suggesting investors would have been better off investing in the risk-free asset.