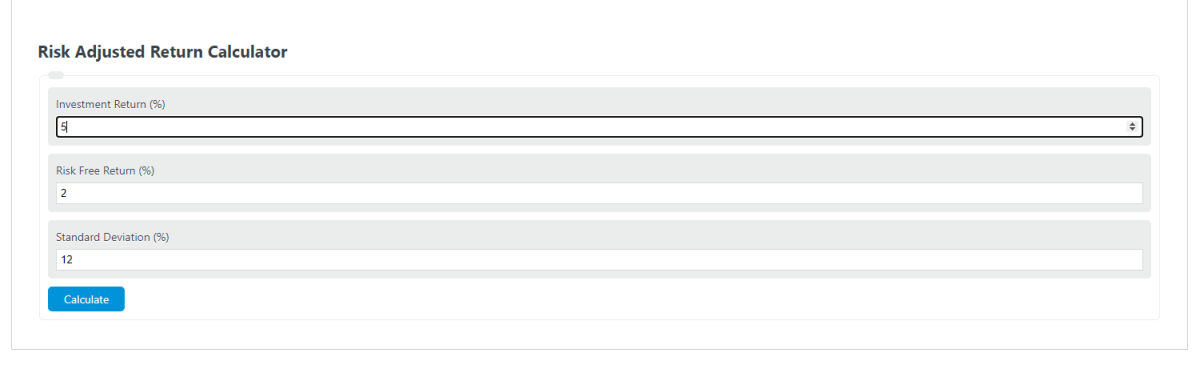

Enter the return of the investment, the risk-free rate, and the investment’s standard deviation into the calculator to determine the risk-adjusted return.

- Risk Premium Calculator

- Default Risk Premium Calculator

- Risk Difference Calculator

- Reward to Risk Ratio Calculator

- Treynor Ratio Calculator

Risk-Adjusted Return Formula

The following formula is used to calculate a risk-adjusted return.

RAR = (IR - RFR) / STD

- Where RAR is the risk-adjusted return

- IR is the investment return (%)

- RFR is the risk-free rate (%)

- STD is the standard deviation

To calculate the Risk-Adjusted return, subtract the risk-free rate from the investment return, then divide by the standard deviation.

Definition

What is a risk-adjusted return?

A risk-adjusted return is a measure of the return of an investment relative to a “risk-free” investment, such as a bond, with respect to the investment standard deviation.

Example Problem

How to calculate a risk-adjusted return?

The following example goes over the necessary steps and information needed to calculate a risk-adjusted return.

First, determine the total percentage return of the investment. In this example problem, the investment return is found to be 6%.

Next, determine the risk-free rate. This is a percentage return an investor could get if they put their money in an asset without risk, like a bond. In this case, the risk-free return is 2%.

Next, determine the standard deviation of the investment return. On average, the investment return has a variation of 10%.

Finally, calculate the risk-adjusted return using the formula above:

RAR = (IR – RFR) / STD

RAR = (6 – 2) / 10

RAR = .4%

FAQ

What is the importance of calculating the risk-adjusted return?

Risk-adjusted return is crucial for investors to understand the return on an investment relative to its risk. This metric helps compare the performance of different investments on a level playing field by accounting for the risk involved, enabling better-informed investment decisions.

How does the risk-free rate affect the risk-adjusted return?

The risk-free rate represents the return an investor would expect from an entirely risk-free investment. It serves as a baseline for measuring the additional risk and potential return from riskier investments. A higher risk-free rate decreases the risk-adjusted return, as the difference between the investment return and the risk-free rate narrows, indicating less compensation for the additional risk taken.

Why is standard deviation used in the risk-adjusted return formula?

Standard deviation measures the amount of variability or dispersion around an average. In the context of risk-adjusted return, it quantifies the volatility of the investment returns. Using standard deviation in the formula allows investors to understand how the actual returns of an investment might deviate from the expected return, providing a clearer picture of the investment’s risk.