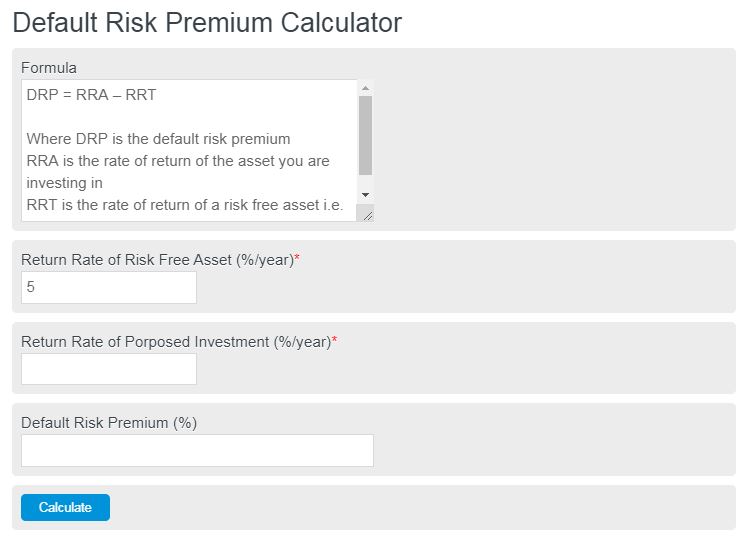

Enter the rate of return for a risk-free asset and the rate of return of the asset you wish to price into the default risk premium calculator below.

- Real Interest Rate Calculator

- Return on Equity Calculator

- Earnings Per Share Calculator

- Cost of Equity Calculator

- Risk Premium Calculator

- Risk-Adjusted Return Calculator

Default Risk Premium Formula

The formula use in the default risk premium calculator above is as follows:

DRP = RRA - RRT

- Where DRP is the default risk premium

- RRA is the rate of return of the asset you are investing in

- RRT is the rate of return of a risk-free asset i.e. a treasury bond.

To calculate default risk premium, subtract the rate of return of a risk free asset from the rate of return on the asset being considered.

Default Risk Premium Definition

In short, this value is a representation of the risk associated with an investment when compared to something like a treasury bond that has, in theory, almost no risk.

How to calculate default risk premium?

How to calculate default risk premium?

- First, determine the return rate of your asset.

Calculate or estimate the annual return of the asset being invested in.

- Next, determine the rate of return of a risk free asset.

This is typically something like a savings bond and they usually return 1-2%.

- Finally, calculate the default risk premium.

Using the formula above, calculate the default risk premium.

FAQ

A default risk premium is defined as the difference between the return on an asset and the return on a risk-free asset.