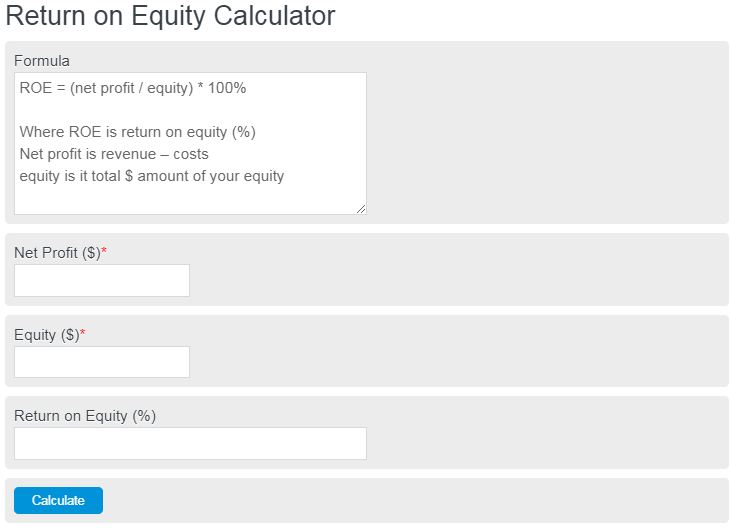

Calculate the return on equity on a percent of total equity to net profit. This return on equity calculator helps you determine how successful your investment may be.

Return on Equity Formula

ROE = (net profit / equity) * 100%

- Where ROE is return on equity (%)

- Net profit is revenue – costs

- equity is the total $ amount of your equity

To calculate the return on equity, divide the net profit by the equity, then multiply by 100.

Return on Equity Definition

A return on equity is the total ratio of net profit to total equity spent on a project.

How to calculate return on equity

Let’s take another look at an example of how to calculate a return on equity. Let’s assume you have an investment in real estate that has equity of $1,000,000.00. This is a multi-family home that has 5 units. Each unit brings in $3,000.00 in rent per month after taxes. Now we need to calculate the total yearly income.

5 units * $3,000.00/months * 12 months = $156,000.00

Finally, we can calculate the ROE because we have the total profit and equity.

ROE = $156,000.00/1,000,000.00*100 = 15.6%

This is also a very solid investment, especially if you consider the increase in the value of the real estate itself.

Let’s take a look at an example of how this might be used in practice. Let’s assume you have a 40% stake in a company in equity. This has a value of $40,000.00. Over the past year that equity has earned a total of $10,000.00 in profit. Use the formula above we get the following:

ROE = (10,000/40,000) * 100 = 25%

A 25% return on equity is nothing to scoff at. If you look at it in terms of an investment, a 25% return on assets yearly is an incredible return compared to something like the stock market. In fact, a return on equity that large is almost unheard of on a larger scale.

FAQ

ROE stands for return on equity. It’s a term used to describe the total % return on an investment in an equity.

For more finance related calculators, click here.