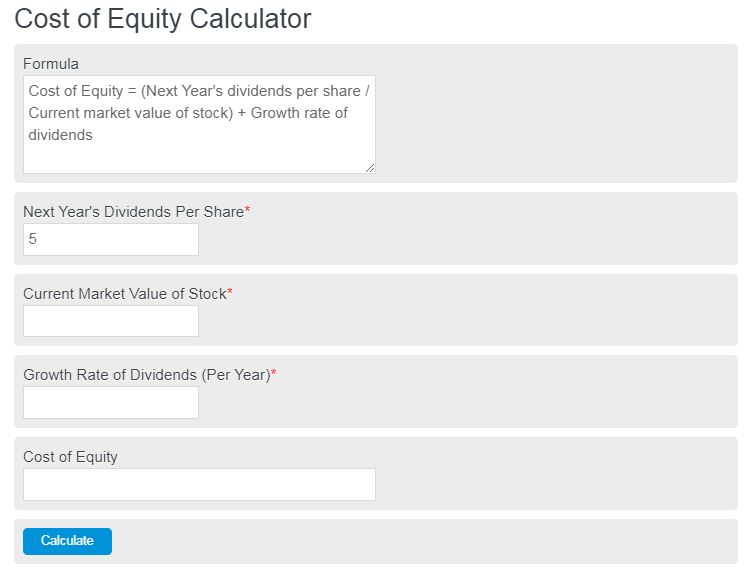

This cost of equity calculator requires the following information: Next year’s dividends per share, the current mark value of the stock, and the growth rate of dividends. Enter this information into the form below to calculate the cost of equity.

- Commission Calculator

- Return on Equity Calculator

- Earning Per Share Calculator

- Real Interest Rate Calculator

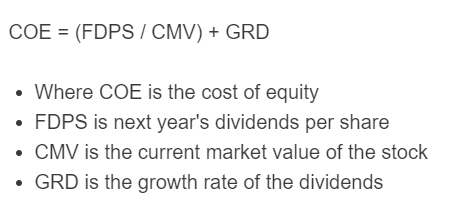

Cost of Equity Formula

The following formula can be used to calculate the cost of equity.

COE = (FDPS / CMV) + GRD

- Where COE is the cost of equity

- FDPS is next year’s dividends per share

- CMV is the current market value of the stock

- GRD is the growth rate of the dividends

Next year’s dividends per share refer to the projected amount of money a company plans to distribute to its shareholders per share of stock in the upcoming year.

The current market value of a stock refers to the current price at which it is being traded in the market.

The growth rate of dividends refers to the rate at which a company’s dividend payments to shareholders increase over time.

What is Cost of Equity?

Cost of equity refers to the return required by equity investors to compensate for the risk they undertake by investing in a particular company. It is the expected rate of return that a company needs to provide to attract and retain equity investors. This cost is determined by various factors, including the company’s profitability, growth prospects, industry dynamics, and the overall risk associated with its operations.

The cost of equity is important as it helps companies evaluate the feasibility of potential investments and projects. By understanding the cost of equity, companies can determine the minimum rate of return they need to generate from their investments to meet the expectations of their shareholders.

It is also a crucial component in calculating the company’s weighted average cost of capital (WACC), which is used in capital budgeting decisions and determining the appropriate discount rate for future cash flows.

How to calculate the cost of equity?

How to calculate cost of equity

- First, determine the current stock value

Look up the current stock value of the security you are analyzing.

- Next, estimate next year’s dividends per share

Based on the current stock price and % dividends, calculate next year’s dividends per share.

- Determine the growth rate of the dividend.

Calculate the growth rate of the dividends using next year’s value and the past year’s value.

- Calculate the cost of equity

Enter the information from steps 1-3 into the equation to calculate the cost of equity.

FAQ

The cost of equity is a financial term used to describe the growth rate of dividends with respect to the current stock price. In other words the net cost of the stock at the current moment.