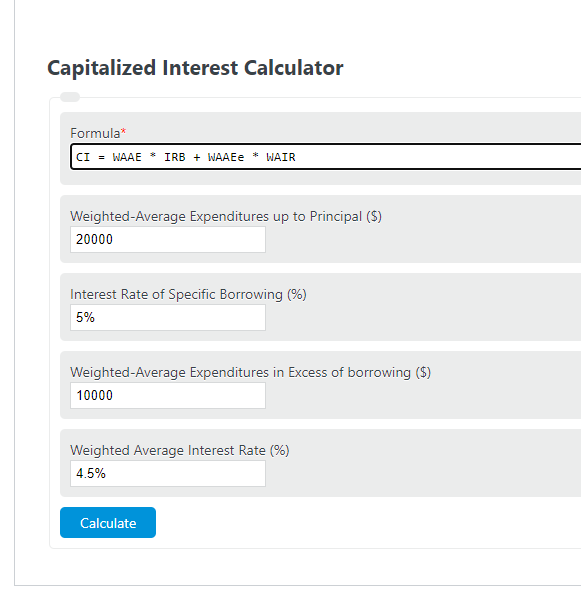

Enter the weighted average accumulated expenditures up to the principal balance of specific borrowing, the interest rate on the specific borrowing, the weighted average accumulated expenditures in excess of specific borrowing, and the weighted-average interest rate to determine the capitalized interest.

- WACC Calculator (Weighted Average Cost of Capital)

- Cost of Capital Calculator

- Value At Risk (VAR) Calculator

- Economic Value Added (EVA) Calculator

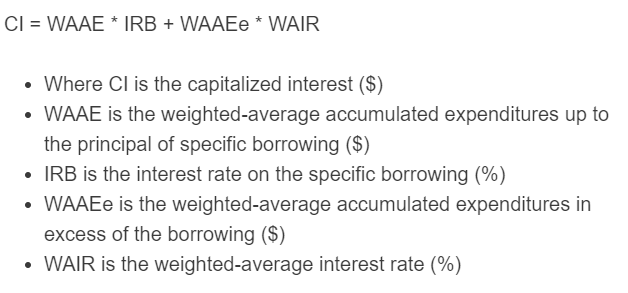

Capitalized Interest Formula

The following formula is used to calculate a capitalized interest.

CI = WAAE * IRB + WAAEe * WAIR

- Where CI is the capitalized interest ($)

- WAAE is the weighted average accumulated expenditures up to the principal of specific borrowing ($)

- IRB is the interest rate on the specific borrowing (%)

- WAAEe is the weighted average accumulated expenditures in excess of the borrowing ($)

- WAIR is the weighted-average interest rate (%)

Capitalized Interest Definition

What is capitalized interest? A capitalized interest is an amount of unpaid interest that get’s added to a loan. In other words, if loan interest is not paid on time, a lender may capitalize that interest and add it to the principal.

Example

How to calculate capitalized interest?

- First, determine the weighted-average accumulated expenditures up to the principal.

For this example, this is $20,000.00.

- Next, determine the interest rate of the borrowing.

For this problem, the borrowing interest rate is 5%.

- Next, determine the accumulated expenditures in excess of the principal.

In this case, the excess expenditures is $10,000.00

- Next, determine the weighted average interest rate.

The average interest rate is 4.5%.

- Finally, calculate the capitalized interest.

Using the formula, the capitalized interest is found to be: 20,000*.05 + 10,000*.045 = $1,450.00.

Frequently Asked Questions

The purpose of calculating capitalized interest is to determine the total interest amount to be added to the loan principal when interest payments are not made on time. This allows both the lender and borrower to understand the total cost of the loan, including any unpaid interest.

Interest is typically capitalized when a borrower fails to make interest payments on time, during the construction or development phase of a project, or in cases where loan terms specifically allow for interest capitalization. The exact circumstances and rules for capitalizing interest may vary depending on the loan agreement and applicable regulations.

Capitalized interest increases the principal balance of the loan, which may result in higher monthly payments or an extended repayment period. This can ultimately increase the total cost of the loan, as interest will be calculated on a higher principal amount, leading to more interest being paid over the life of the loan.

Simple interest is calculated only on the initial principal balance of a loan, whereas capitalized interest is calculated on the unpaid interest that is added to the principal balance. Simple interest remains constant throughout the loan period, while capitalized interest can cause the principal balance to increase over time if interest payments are not made on time or if it’s specified in the loan terms.

Capitalized interest may be tax deductible in certain situations, such as when it is related to the construction or development of a property or asset. The rules and requirements for deducting capitalized interest can vary depending on tax laws and regulations in the relevant jurisdiction. It is advisable to consult a tax professional to determine the tax implications of capitalized interest in specific circumstances.