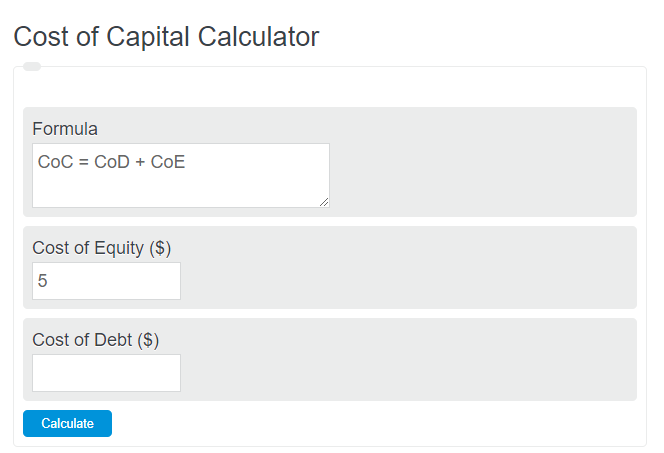

Enter the total cost of debt and total cost of equity of a project into the calculator to determine the total cost of capital.

- Cost of Debt Calculator

- Cost of Equity Calculator

- WACC Calculator (Weighted Average Cost of Capital)

- AFN (Additional Funds Needed) Calculator

- DDM – Dividend Discount Model Calculator

- Cost of Funds Calculator

- Contributed Capital Calculator

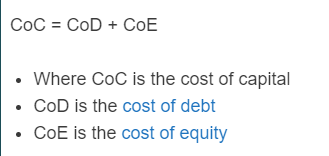

Cost of Capital Formula

The following formula is used to calculate a simple cost of capital:

CoC = CoD + CoE

- Where CoC is the cost of capital

- CoD is the cost of debt

- CoE is the cost of equity

To calculate cost of capital, sum the total cost of debt and the total cost of equity together.

Cost of Capital Definition

What is a cost of capital? A cost of capital is defined as the total cost or fund amount required to start and completed a project. This is most often used when talking about things like large real-estate projects of factories, but it can also be used to describe smaller-scale projects.

Is the cost of capital the same as WACC? The simple cost of capital described by the formula above is not the same as WACC (weighted average cost of capital). The WAAC includes the percentage of each debt financing as well as the tax rate into account while the simple cost of capital is just the sum of the cost of debt and equity.

Why is cost of capital important? A cost of capital is important in understanding the financial feasibility of a project. It used in the calculations of both the return on investment and the initial project cost. Calculating the cost of capital allows a company to decide whether it can move forward with a project.

Cost of Capital Example

Example Problem:

First, determine whether the speaker is in parallel or series. For this example, the speaker is in parallel.

Next, determine the impedance of each individual component. For this problem, these are 4, 12, and 14 respectively.

Finally, calculate the speaker impedance using the formula above:

Series: I = X1 + X2 + X3 ….

Series: I = 4 + 12 + 14

Series: I = 30 ohms

FAQ

If there is a financing option or subsidy program in place, sometimes the cost of capital can be negative.

A cost of capital is the sum of the cost of equity and the cost of debt.