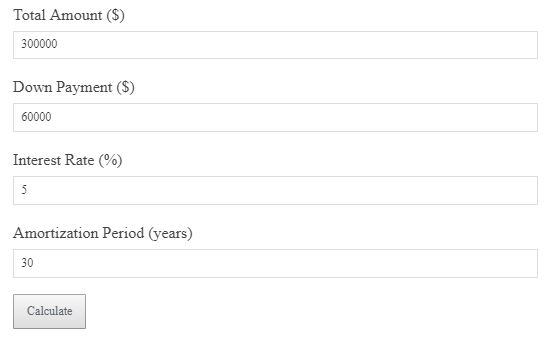

Use the calculator below to help schedule your monthly mortgage payments in order to pay off your mortgage early. The following is the formula used to determine the fixed monthly payment to amortize the loan.

- Loan Calculator

- ROI Calculator – Return on Investment

- PITI Calculator (Mortgage Monthly Payments)

- Discount Point Calculator

Mortgage Formula

P = L[c(1 + c)n]/[(1 + c)n – 1]

Where:

i = IRR (Interest Rate)

L = Loan amount

F = Points and all other lender fees

P = Monthly payment

n = Month when the balance is paid in full

Bn = Balance in month n

4 Tips for Paying off your Mortgage

First, before you start trying to pay off your mortgage, check with your mortgage company to see if they accept early payment. Some companies will penalize you for prepayment if not done during a certain time period. With that said, here are some quick tips for paying off your mortgage.

1) Refinance your Mortgage

If you are in a financial position to do so, refinancing to a shorter-term mortgage can lower interest rates, and will reduce the total amount you owe by the end of the payment. If you are already at a fairly low-interest rate, it might not make sense to refinance. If this is the case, simply pay off your mortgage at an increased rate to reduce final interest.

2) Maximize your down payment

This one is pretty self-explanatory. The larger the down payment, the less interest you will end up paying. In fact, if you can purchase a house with 100% down, this is almost always preferred. This is due to real estates increasing value as time goes on. With the exception of financial crises, real estate is almost always a sound investment.

3) Make extra payments when you can afford it.

There does not have to be any specific time frame such as every quarter or year. Simply put down extra payments when funds become available. Unless you have a very low interest rate on your mortgage, it almost always makes sense to put extra money into paying off debt than investing. That is of course unless for some reason you are some expert investor. In which case you probably wouldn’t be worried about paying off mortgages anyway!

4) Downsize/Buy Houses that meet your finances

Oftentimes people get caught up in the home buying experience and pay for more than they can afford. It’s extremely important to keep your mortgage at a reasonable level, typically less than 25% monthly income. There’s no way to know what financial troubles might impact you in the future.

if you do get caught up in the home buying experience and get more than you bargained for, think about downsizing. That is selling your house and getting a smaller house. Often times you can make a significant down payment on the new house with the money from selling your old one and this will go a long way.

No matter what, keep up on your loan payment. Defaulting on a mortgage can go south very quickly.

Types of Mortgages and Home Loans

Fixed Mortgage

– A fixed mortgage is a mortgage with a fixed interest rate over the entire life of the loan. The monthly payments will not change throughout the entire mortgage time period. For example, if you have a 40-year mortgage at a 5% interest rate, in 39 years you will still be paying the same monthly payment. This option can be considered good for long-term mortgages because of inflation and home value increases.

Adjustable Mortgage

– An adjustable mortgage, or adjustable-rate mortgage, will have varying interest rates throughout its life. This option is often chosen to pay off a loan quicker in the short term. For example for a 20-year loan, you may pay 5% for 10 years and then 2% for the next 10 years, or vice-versa.

Conventional Mortgage

-The conventional mortgage is one that is not unsure or backed by the federal government. These loans typically are used for buyers that have significant down payments as banks will offer much lower interest rates with a larger down payment.

Government Insured Mortgage

-A government-insured mortgage is one that is backed by one of several government agencies. These loans are typically taken out by individuals with lower down payments. The government will allow the home buyer to purchase a house at a lower interest rate, in exchange for the risk that you may default and lose the house, and that you pay extra insurance on top of it. This will make your monthly payments larger than a typical conventional loan.