Enter the principal mortgage amount, term length, interest rate, tax, and insurance into the PITI Calculator. The calculator will display your actual monthly payments.

- Mortgage Calculator

- Home Affordability Calculator

- Net Effective Rent Calculator

- Yield Maintenance Calculator

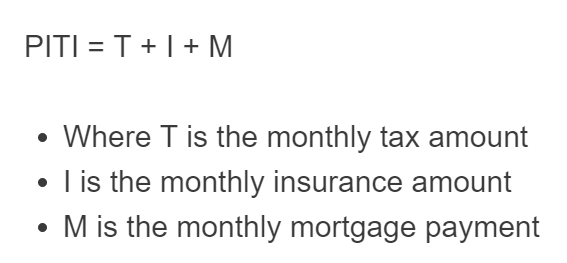

PITI Formula

The following formula calculates the monthly payment on a house, considering interest, tax, and insurance.

PITI = T + I + M

- Where T is the monthly tax amount

- I is the monthly insurance amount

- M is the monthly mortgage payment

PITI Definition

PITI is an acronym that represents the four main components of a mortgage payment: Principal, Interest, Taxes, and Insurance. These elements are crucial to understanding because they determine the total amount of money a homeowner will need to pay each month toward their mortgage.

Firstly, the principal is the initial amount borrowed from a lender to purchase a home. It is the core amount that needs to be repaid over the life of the loan.

The interest, on the other hand, is the additional cost charged by the lender for borrowing the money. It is calculated as a percentage of the outstanding principal balance and can significantly impact the overall cost of the mortgage.

Taxes refer to property taxes that homeowners must pay to local governments. These taxes are based on the assessed value of the property and are used to fund various public services and infrastructure.

Property taxes can vary depending on the location and value of the property.

Lastly, insurance in the context of PITI refers to homeowner’s insurance, which is necessary to protect the property and its contents against potential damage or loss.

It provides financial coverage in case of events such as fire, theft, or natural disasters. Lenders typically require homeowners to maintain insurance throughout the mortgage term, ensuring protection for both the homeowner and the lender.

How to calculate PITI?

How to calculate PITI

- First, determine your total home tax

For use in the calculate above, you should enter your yearly home tax amount. The calculator then converts this to a monthly amount. If not using the calculator, you need to determine your monthly amount yourself for use in the formula above.

- Next, determine your insurance amount

Again, this will be your yearly insurance amount for use in the calculator, and monthly if using the formula.

- Next, determine your monthly mortgage payment

Using the principal amount, term length, and interest rate, calculator your monthly mortgage rate.

- Finally, calculate the PITI

Using the information from steps 1 to 3, calculate the PITI.

FAQ

PITI stands for principal, income, tax, insurance. In essence, PITI is an estimate of your average monthly expenses on your home taking into account tax and insurance.

In short, it doesn’t directly affect your mortgage payment, but it is an extended cost that’s a direct result of owning a home.