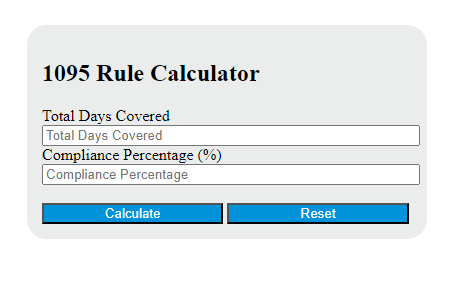

Enter the total number of days covered by health insurance over a 3-year period and 1095 into the calculator to determine the compliance percentage.

- Compliance Time Calculator

- Health Insurance Cost Per Month Calculator

- Insurance Loss Ratio Calculator

1095 Rule Formula

The following formula is used to calculate the 1095 Rule compliance.

C = (D / 1095) * 100

Variables:

- C is the compliance percentage (%)

- D is the total number of days covered by health insurance over a 3-year period (days)

To calculate the 1095 Rule compliance, divide the total number of days covered by health insurance over a 3-year period by 1095. Multiply the result by 100 to get the compliance percentage. If the compliance percentage is 100% or more, the individual is in compliance with the 1095 Rule. If the compliance percentage is less than 100%, the individual may face a penalty under the Affordable Care Act.

What is a 1095 Rule?

The 1095 Rule refers to the requirement under the Affordable Care Act (ACA) that all individuals must have health insurance coverage for at least 1095 days out of a 3-year period, or face a penalty. This rule is enforced through forms 1095-A, 1095-B, and 1095-C, which are sent by insurance providers and employers to both individuals and the IRS to confirm coverage.

How to Calculate 1095 Rule?

The following steps outline how to calculate the compliance percentage using the 1095 Rule formula.

- First, determine the total number of days covered by health insurance over a 3-year period (D).

- Next, divide D by 1095.

- Then, multiply the result by 100.

- Finally, calculate the compliance percentage (C).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Total number of days covered by health insurance over a 3-year period (D) = 730