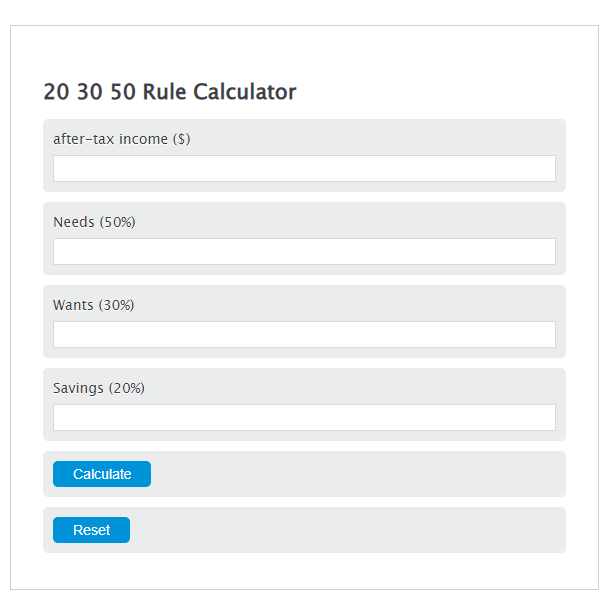

Enter the after-tax income ($) and the budget rate into the Calculator. The calculator will evaluate the 20 30 50 Rule.

- 20/4/10 Rule Calculator

- Empirical Rule Calculator (68%, 95%, 99.7%)

- Home Affordability Calculator (28/36 rule)

20 30 50 Rule Formula

B = ATI * R

Variables:

- B is the 20 30 50 Rule ($)

- ATI is the after-tax income ($)

- R is the budget rate

To calculate 20 30 50 Rule, multiply the after-tax income by each budget rate, i.e. .20,.30, and .50.

How to Calculate 20 30 50 Rule?

The following steps outline how to calculate the 20 30 50 Rule.

- First, determine the after-tax income ($).

- Next, determine the budget rate.

- Next, gather the formula from above = B = ATI * R.

- Finally, calculate the 20 30 50 Rule.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

after-tax income ($) = 356

budget rate = 80

Frequently Asked Questions

What is the 20 30 50 Rule in budgeting?

The 20 30 50 Rule is a simple budgeting method that suggests you should allocate 20% of your after-tax income to savings and debt repayment, 30% to wants or flexible spending, and 50% to needs or essential expenses.

How can the 20 30 50 Rule help me manage my finances?

By following the 20 30 50 Rule, you can create a balanced budget that covers your essential needs, allows for some discretionary spending, and ensures you are saving or paying off debt. This can help you live within your means and work towards financial goals.

Is the 20 30 50 Rule suitable for everyone?

While the 20 30 50 Rule is a helpful guideline for many, it may not fit everyone’s financial situation perfectly. You may need to adjust the percentages based on your specific circumstances, such as having higher debt or living in an area with a high cost of living.

Can I use the 20 30 50 Rule if I have irregular income?

Yes, you can use the 20 30 50 Rule with irregular income by calculating your average income over a period, such as six months or a year. This average can then be used to apply the rule for budgeting purposes. Adjustments may be needed depending on the fluctuation of your income.