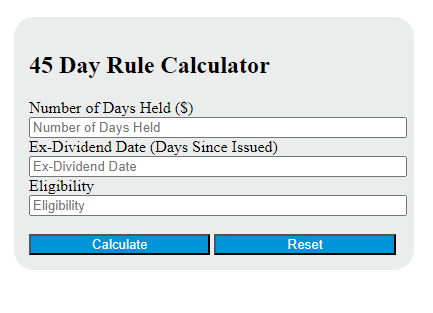

Enter the number of days the investor has held the security and the ex-dividend date into the calculator to determine the eligibility for the 45 Day Rule tax credit.

45 Day Rule Formula

The following formula is used to calculate the eligibility for the 45 Day Rule tax credit.

Eligibility = (H >= 45) AND (H <= (D + 45))

Variables:

- Eligibility is a boolean value indicating whether the investor is eligible for the tax credit (True or False)

- H is the number of days the investor has held the security ($)

- D is the ex-dividend date (number of days since the security was issued)

To calculate the eligibility for the 45 Day Rule tax credit, check if the number of days the investor has held the security is greater than or equal to 45. Also, check if the number of days the investor has held the security is less than or equal to the sum of the ex-dividend date and 45. If both conditions are met, the investor is eligible for the tax credit.

What is a 45 Day Rule?

The 45 Day Rule is a regulation in the United States tax code that pertains to the holding period for preferred stocks or bonds before a dividend or interest payment is made. According to this rule, an investor must hold these securities for at least 45 days during the 91-day period beginning 45 days before the ex-dividend date to qualify for a tax credit on the dividend or interest received. This rule is designed to prevent investors from buying securities just before a dividend is paid and then selling them immediately afterward, essentially earning income without any significant investment risk.

How to Calculate 45 Day Rule?

The following steps outline how to calculate the 45 Day Rule using the given formula.

- First, determine the number of days the investor has held the security (H).

- Next, determine the ex-dividend date (D).

- Next, calculate the sum of D and 45.

- Next, check if H is greater than or equal to 45.

- Next, check if H is less than or equal to the sum of D and 45.

- Finally, use the given formula Eligibility = (H >= 45) AND (H <= (D + 45)) to determine the eligibility of the investor for the tax credit.

Example Problem :

Use the following variables as an example problem to test your knowledge.

H = 50

D = 30