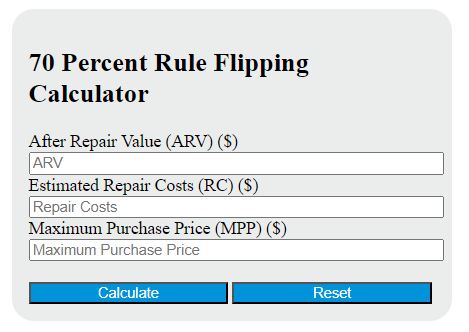

Enter the after repair value of the property and the estimated repair costs into the calculator to determine the maximum purchase price. This calculator can also evaluate any of the variables given the others are known.

70 Percent Rule Flipping Formula

The following formula is used to calculate the maximum purchase price for a house flip using the 70 percent rule.

MPP = ARV * 0.7 - RC

Variables:

- MPP is the maximum purchase price ($)

- ARV is the after repair value of the property ($)

- RC is the estimated repair costs ($)

To calculate the maximum purchase price, multiply the after repair value of the property by 0.7, then subtract the estimated repair costs from the result. This will give you the maximum amount you should pay for the property to ensure a profitable flip according to the 70 percent rule.

What is a 70 Percent Rule Flipping?

The 70 percent rule is a common term used among real estate investors when flipping houses. It states that an investor should pay no more than 70% of the after-repair value (ARV) of a property minus the repairs needed. The ARV is what a home is worth after it is fully repaired. This rule is a guideline that investors use to determine how much to pay for a property to make a profit after it’s renovated and resold.

How to Calculate 70 Percent Rule Flipping?

The following steps outline how to calculate the 70 Percent Rule Flipping.

- First, determine the after repair value of the property (ARV) ($).

- Next, determine the estimated repair costs (RC) ($).

- Next, multiply the ARV by 0.7.

- Subtract the estimated repair costs (RC) from the result of step 3.

- Finally, calculate the maximum purchase price (MPP).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

after repair value of the property (ARV) ($) = 200,000

estimated repair costs (RC) ($) = 30,000