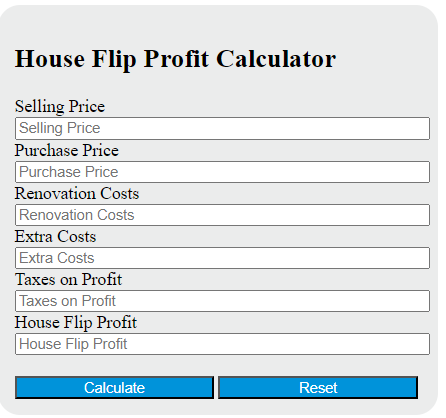

Enter the selling price, purchase price, renovation costs, extra costs, and taxes into the calculator to determine the house flip profit.

House Flip Profit Formula

The following formula is used to calculate the profit from flipping a house.

HP = SP - (PP + RC + EC + TC)

Variables:

- HP is the house flip profit

- SP is the selling price of the house

- PP is the purchase price of the house

- RC is the renovation costs

- EC is the extra costs (like closing costs, financing costs, etc.)

- TC is the taxes on the profit

To calculate the house flip profit, subtract the sum of the purchase price, renovation costs, extra costs, and taxes from the selling price of the house.

What is a House Flip Profit?

A House Flip Profit refers to the financial gain that an investor makes from buying a property at a low price, often in need of renovation, improving it, and then selling it at a higher price. The profit is the difference between the purchase price (including renovation costs and any other expenses incurred during the holding period) and the selling price. This is a common real estate investment strategy used to generate a quick return on investment.

How to Calculate House Flip Profit?

The following steps outline how to calculate the House Flip Profit.

- First, determine the selling price of the house (SP).

- Next, determine the purchase price of the house (PP).

- Next, determine the renovation costs (RC).

- Next, determine the extra costs (EC) such as closing costs, financing costs, etc.

- Finally, calculate the House Flip Profit (HP) using the formula: HP = SP – (PP + RC + EC + TC).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Selling price of the house (SP) = $250,000

Purchase price of the house (PP) = $200,000

Renovation costs (RC) = $30,000

Extra costs (EC) = $10,000

Taxes on the profit (TC) = $5,000