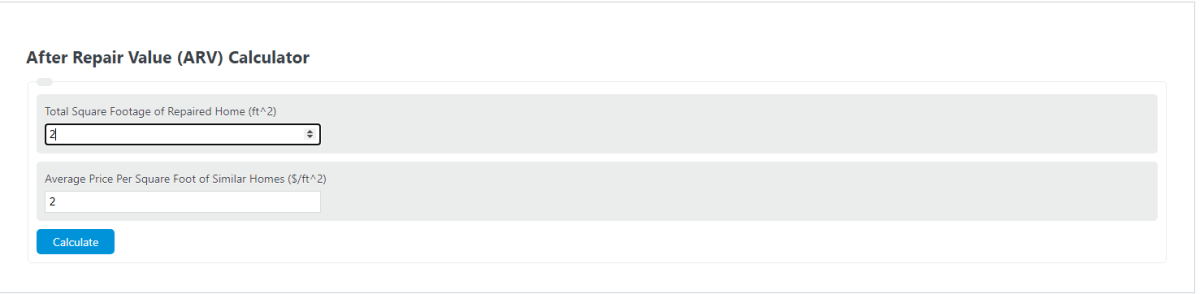

Enter the average price per square foot of similar properties and the total square footage to determine the after-repair value (ARV).

- Cost Per Square Foot Calculator

- Rental Yield Calculator

- Floor to Area Ratio Calculator

- Rent To Value Calculator

- Build Up Rate Calculator

After Repair Value Formula

The following formula is used to calculate an after-repair value:

ARV = ACSF * TSF

- Where ARV is the after-repair value ($)

- ACSF is the average cost or price per square foot that repaired homes have sold for in the area ($/ft^2)

- TSF is the total square feet (ft^2)

To calculate the after-repair value, multiply the cost per square foot of repair by the total area.

After Repair Definition

What is ARV?

ARV, short for after-repair value, is a term used in real estate to describe the value of a home after it has been repaired to modern standards.

This term is brought up mostly in the “flipping market” since the goal of that market is to repair and re-sell old homes.

Example Problem

How to calculate ARV?

- First, determine the total square footage of livable space in the house.

For this example, the home that is being repaired has a total of 2,000 square feet.

- Next, determine the average price per square foot that similar homes have sold for in the area.

These should be the price per square foot of homes roughly the same size that has also been repaired. In this case, those homes have sold for $200 /ft^2.

- Finally, calculate the after repair value using the formula.

Using the formula above, the ARV is calculated to be:

ARV = ACSF * TSF

ARV = $200 * 2,000

ARV = $400,000

FAQ

What factors can affect the after-repair value (ARV) of a property?

The ARV of a property can be influenced by several factors including the location of the property, the quality and extent of repairs and renovations, market trends, the property’s size and layout, and the sale prices of comparable properties in the area.

How accurate is the ARV, and can it change over time?

The ARV is an estimate based on current market conditions and the assumed value of repairs. It can change over time due to fluctuations in the real estate market, changes in the neighborhood, or if the scope of the repairs and renovations changes during the project.

Can the ARV be used for financing or refinancing purposes?

Yes, lenders often use the ARV to determine the loan amount for financing or refinancing fix-and-flip projects. The ARV helps lenders assess the potential value of the property after repairs, which influences the loan terms and amount they are willing to offer.