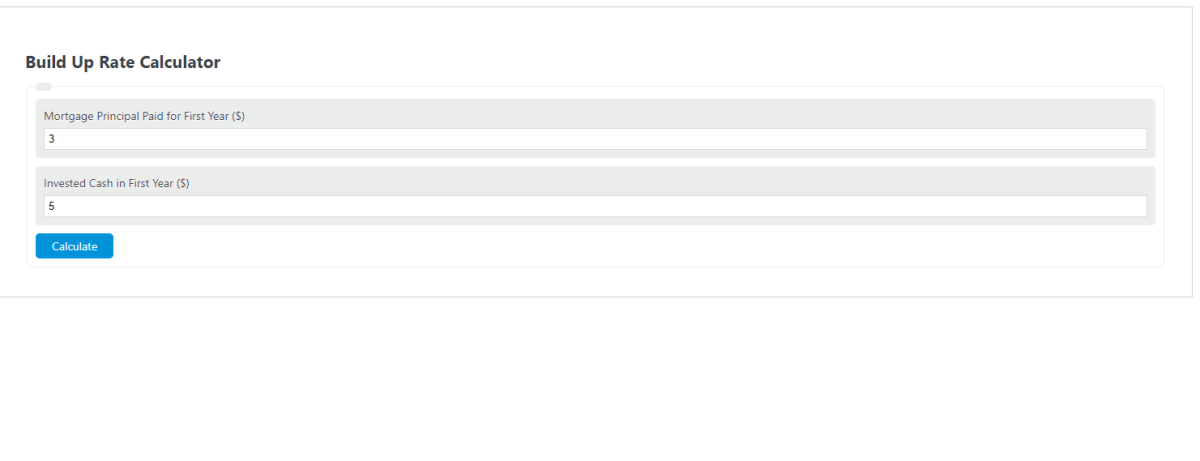

Enter the mortgage principal paid in year 1 and the initial cash invested in year 1 into the calculator to determine the build up rate.

- PITI Calculator (Mortgage Monthly Payments)

- Constant/Conditional Prepayment Rate (CPR) Calculator

- Rental Yield Calculator

- Rent To Value Calculator

- Ground Rent Purchase Calculator

- Mortgage Service Ratio Calculator

Build Up Rate Formula

The following equation is used to calculate the Build Up Rate.

BUR = MPP / ICI

- Where BUR is the build up rate

- MPP is the mortgage principal paid in the first year

- ICI is the initial cash invested into the property in the first year

To calculate an equity build up rate, divide the principal paid for the yar by the cash invested in the first year.

What is a Build Up Rate?

Definition:

A build up rate, or commonly known as an equity build up rate, is a ratio of the mortgage principal paid in the first year to the cash invested in the first year. It’s one of many metric investors use to analyze the value of properties.

How to Calculate Build Up Rate?

Example Problem:

The following example outlines the steps and information needed to calculate Build Up Rate.

First, determine the mortgage principal paid in the first year. In this example, the principal paid is $10,000.

Next, determine the cash invested in the first year. The initial cash invested for this property was $20,000.00.

Finally, calculate the equity build up rate using the formula above:

BUR = MPP / ICI

BUR = 10,000 / 20,000

BUR = .500 $equity/$invested