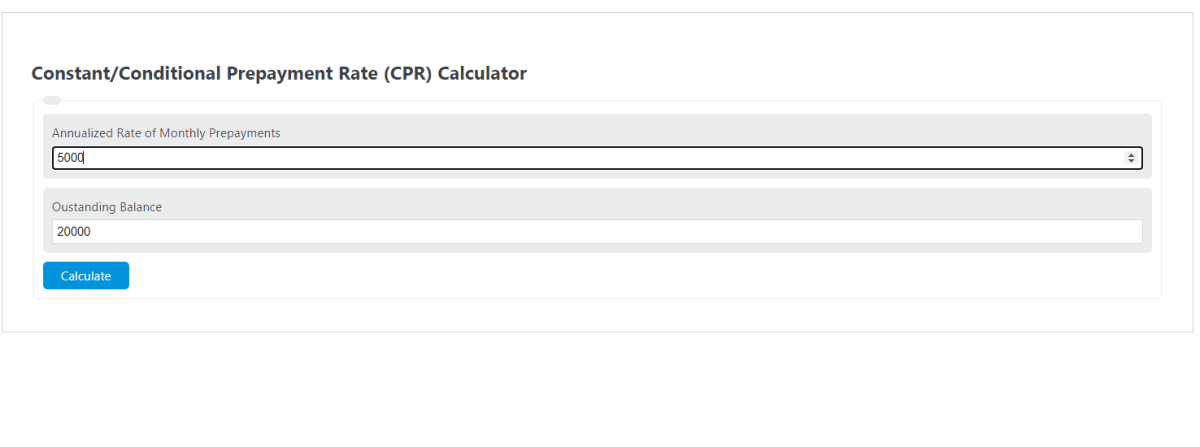

Enter the annualized rate of monthly prepayments and the outstanding balance at the beginning of the period to calculate the CPR.

- Coupon Rate Calculator

- PITI Calculator (Mortgage Monthly Payments)

- Yield Maintenance Calculator

- Lease-to-Own Calculator

CPR Formula

The following formula is used to calculate a constant/conditional prepayment rate.

CPR = ARM / OB

- Where CPR is the constant prepayment rate

- ARM is the annualized rate of monthly prepayments

- OB is the outstanding balance at the beginning of the period

To calculate CRP, divide the annualized rate of monthly prepayments by the outstanding balance at the beginning of the period.

What is a constant prepayment rate?

Definition:

A constant prepayment rate (CPR) measures the compounded percentage of a loan amount that is expected to be prepared in the coming year.

Both home equity loans and student loans use this model of prepayment.

How to calculate a constant prepayment rate?

Example Problem:

The following example outlines how to calculate a constant prepayment rate.

First, determine the annualized rate of monthly prepayments. In this example, the annualized rate of monthly prepayments is $5000.

Next, determine the outstanding balance at the beginning of the period. In this case, the outstanding balance is $20,000.00.

Finally, calculate the conditional prepayment rate using the formula above:

CPR = ARM / OB

CPR = 5000 / 20000

CPR = .25 = 25%

FAQ

What factors can affect the Constant Prepayment Rate (CPR)?

Several factors can influence the CPR, including prevailing interest rates, the borrower’s financial health, changes in property values, and the overall economic environment. For instance, lower interest rates might encourage refinancing, leading to higher prepayment rates.

How does CPR impact investors in mortgage-backed securities?

CPR directly affects the cash flow and yield of mortgage-backed securities. Higher CPR rates can lead to shorter cash flow durations and potentially lower yields, as the principal is repaid faster than expected. Conversely, lower CPR rates can extend the duration of cash flows, affecting yield predictions and investment value.

Can CPR be used for all types of loans?

While CPR is primarily used to analyze prepayment risks in mortgage loans and mortgage-backed securities, it can be applied to any loan type with prepayment features, such as student loans and car loans. However, the specific factors influencing prepayment may vary by loan type.