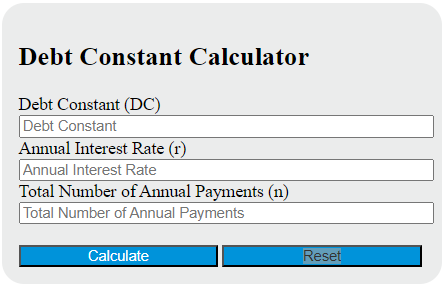

Enter the annual interest rate and total number of annual payments into the calculator to determine the Debt Constant.

- Debt Service Coverage Ratio Calculator

- Serviceability Ratio Calculator

- Mortgage Service Ratio Calculator

Debt Constant Formula

The following formula is used to calculate the Debt Constant.

DC = (r * (1 + r)^n) / ((1 + r)^n - 1)

Variables:

- DC is the Debt Constant (decimal)

- r is the annual interest rate (decimal)

- n is the total number of annual payments

What is a Debt Constant?

A debt constant, also known as a loan constant, is a percentage that represents the annual debt service divided by the total loan amount. It is used to compare the debt levels of different loans. The debt constant gives the percentage of the loan amount that the borrower must pay annually to service the loan, including both principal and interest payments. This allows borrowers and lenders to understand the annual cost of a loan relative to its total amount.

How to Calculate Debt Constant?

The following steps outline how to calculate the Debt Constant.

- First, determine the annual interest rate (r) as a decimal.

- Next, determine the total number of annual payments (n).

- Next, use the formula: DC = (r * (1 + r)^n) / ((1 + r)^n – 1).

- Finally, calculate the Debt Constant (DC).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Annual interest rate (r) = 0.05

Total number of annual payments (n) = 10