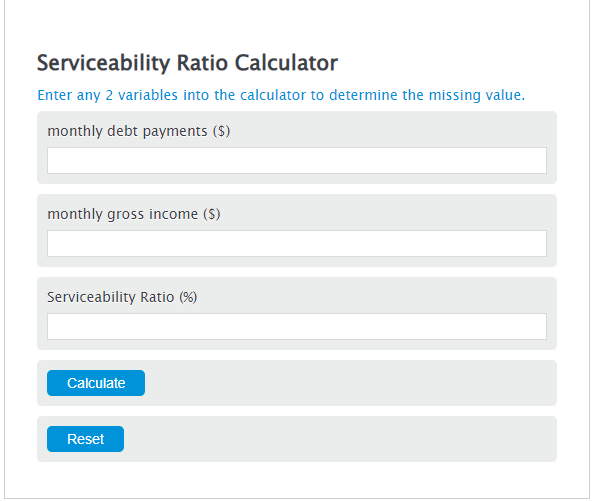

Enter the monthly debt payments ($) and the monthly gross income ($) into the Calculator. The calculator will evaluate the Serviceability Ratio.

Serviceability Ratio Formula

SRV = MD / MI * 100

Variables:

- SRV is the Serviceability Ratio (%)

- MD is the monthly debt payments ($)

- MI is the monthly gross income ($)

To calculate Serviceability Ratio, divide the monthly debt payments by the monthly income, then multiply by 100.

How to Calculate Serviceability Ratio?

The following steps outline how to calculate the Serviceability Ratio.

- First, determine the monthly debt payments ($).

- Next, determine the monthly gross income ($).

- Next, gather the formula from above = SRV = MD / MI * 100.

- Finally, calculate the Serviceability Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

monthly debt payments ($) = 3000

monthly gross income ($) = 5000

FAQs about Serviceability Ratio

What is a good serviceability ratio?

A good serviceability ratio typically falls below 35%. This indicates that a smaller portion of your income is going towards debt payments, suggesting a healthy financial situation. However, this can vary based on lenders and the type of loan.

How does a high serviceability ratio affect loan approval?

A high serviceability ratio, usually above 35%, can negatively impact loan approval chances. Lenders may view it as an indicator of high financial risk, suggesting that a significant portion of income is already committed to debt payments.

Can improving your serviceability ratio help in refinancing?

Yes, improving your serviceability ratio can significantly help in refinancing. A lower ratio means a better financial standing, making you more attractive to lenders for better loan terms or interest rates.

What factors can affect my serviceability ratio?

Several factors can affect your serviceability ratio, including your total monthly debt payments, your gross monthly income, any changes in your income, additional debts you may take on, and changes in interest rates.