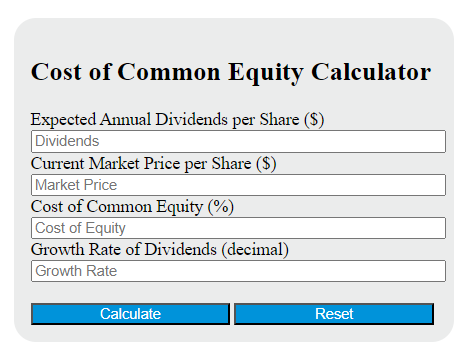

Enter the expected annual dividends per share and the current market price per share, along with the growth rate of dividends into the calculator to determine the cost of common equity.

Cost Of Common Equity Formula

The following formula is used to calculate the cost of common equity.

Ke = D1 / P0 + g

Variables:

- Ke is the cost of common equity (%)

- D1 is the expected annual dividends per share ($)

- P0 is the current market price per share ($)

- g is the growth rate of dividends (decimal)

To calculate the cost of common equity, divide the expected annual dividends per share by the current market price per share. Then, add the growth rate of dividends to the quotient. The result is the cost of common equity.

What is the Cost Of Common Equity?

The cost of common equity refers to the return rate that a company must provide to its common equity investors to maintain their interest and investment in the business. It is essentially the compensation the investor expects for taking on the risk associated with investing in the company’s equity. This cost is a significant component of a company’s capital structure and is often used in financial analysis and decision-making.

How to Calculate Cost Of Common Equity?

The following steps outline how to calculate the Cost of Common Equity.

- First, determine the expected annual dividends per share (D1) ($).

- Next, determine the current market price per share (P0) ($).

- Next, determine the growth rate of dividends (g) (decimal).

- Next, gather the formula from above = Ke = D1 / P0 + g.

- Finally, calculate the Cost of Common Equity (Ke).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

expected annual dividends per share (D1) ($) = 2

current market price per share (P0) ($) = 50

growth rate of dividends (g) (decimal) = 0.05