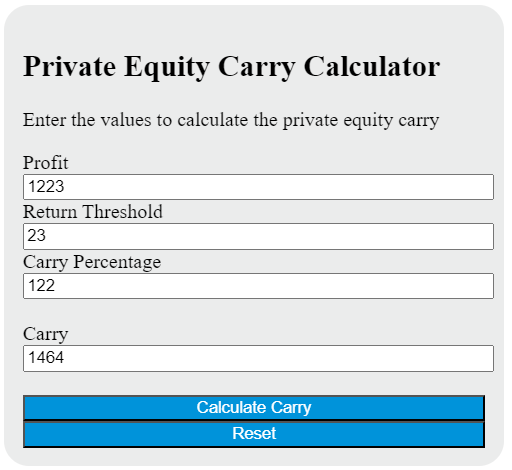

Enter the total profit generated by the investment and the minimum return required for the carry to be triggered into the calculator to determine the private equity carry; this calculator can also evaluate the total profit or the minimum return, given the other variables are known.

Private Equity Carry Formula

The following formula is used to calculate the private equity carry:

Carry = (Profit - ReturnThresh) * CarryPercent

Variables:

- Carry is the private equity carry

- Profit is the total profit generated by the investment

- ReturnThreshold is the minimum return required for the carry to be triggered

- CarryPercentage is the percentage of the profit allocated to the carry

To calculate the private equity carry, subtract the return threshold from the total profit generated by the investment. Multiply the result by the carry percentage to determine the amount of carry.

What is a Private Equity Carry?

A Private Equity Carry, also known as carried interest, is a share of the profits of an investment or investment fund that is paid to the investment manager in excess of the amount that the manager contributes to the partnership. It serves as a performance fee, rewarding the manager for enhancing the fund’s performance. The standard carried interest is typically around 20% of the fund’s annual profit, but this can vary depending on the fund’s structure and strategy. This means that if a fund generates a significant profit in a given year, the fund’s managers receive a proportion of this profit (usually 20%) as a form of incentive compensation. This aligns the interests of the fund managers with those of the investors, as the managers stand to gain significantly if the fund performs well.

How to Calculate Private Equity Carry?

The following steps outline how to calculate the Private Equity Carry:

- First, determine the total investment amount ($).

- Next, determine the preferred return rate (%).

- Next, determine the hurdle rate (%).

- Next, determine the carried interest rate (%).

- Next, calculate the preferred return amount by multiplying the total investment amount by the preferred return rate.

- Next, calculate the hurdle amount by subtracting the preferred return amount from the total investment amount.

- Next, calculate the carried interest amount by multiplying the hurdle amount by the carried interest rate.

- Finally, calculate the Private Equity Carry by subtracting the preferred return amount from the carried interest amount.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Total investment amount ($) = 500,000

Preferred return rate (%) = 8

Hurdle rate (%) = 10

Carried interest rate (%) = 20