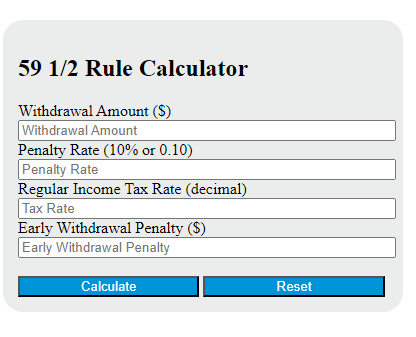

Enter the withdrawal amount and both the penalty and regular income tax rates into the calculator to determine the early withdrawal penalty.

59 1/2 Rule Formula

The following formula is used to calculate the penalty for early withdrawal from a retirement account according to the 59 1/2 rule.

EW = (WD * P) + (WD * T)

Variables:

- EW is the total amount of early withdrawal penalty ($)

- WD is the withdrawal amount from the retirement account ($)

- P is the penalty rate (10% or 0.10)

- T is the regular income tax rate (decimal)

To calculate the early withdrawal penalty, multiply the withdrawal amount by the penalty rate. Then, multiply the withdrawal amount by the regular income tax rate. Add these two results together to get the total amount of the early withdrawal penalty. If the individual is 59 1/2 or older, the penalty rate is 0, so there is no early withdrawal penalty.

What is a 59 1/2 Rule?

The 59 1/2 rule refers to the age at which an individual can begin withdrawing funds from retirement accounts, such as a 401(k) or an IRA, without incurring a penalty. Prior to reaching the age of 59 1/2, withdrawals from these accounts are typically subject to a 10% early withdrawal penalty in addition to regular income tax. This rule is designed to encourage individuals to leave their retirement savings untouched until retirement.

How to Calculate 59 1/2 Rule?

The following steps outline how to calculate the 59 1/2 Rule using the formula: EW = (WD * P) + (WD * T).

- First, determine the withdrawal amount from the retirement account (WD) ($).

- Next, determine the penalty rate (P) (10% or 0.10).

- Next, determine the regular income tax rate (T) (decimal).

- Next, use the formula EW = (WD * P) + (WD * T) to calculate the total amount of early withdrawal penalty (EW) ($).

- Finally, calculate the 59 1/2 Rule.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

withdrawal amount from the retirement account (WD) ($) = 5000

penalty rate (P) = 0.10

regular income tax rate (T) (decimal) = 0.25