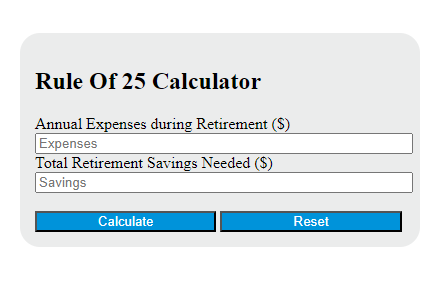

Enter the annual expenses expected during retirement into the calculator to determine the total retirement savings needed.

Rule of 25 Formula

The following formula is used to calculate the total amount needed for retirement based on the Rule of 25.

RS = A * 25

Variables:

- RS is the total retirement savings needed ($)

- A is the annual expenses expected during retirement ($)

To calculate the total retirement savings needed, multiply the annual expenses expected during retirement by 25. This is based on the assumption that a retiree can withdraw 4% of their retirement savings each year without running out of money for at least 30 years.

What is a Rule of 25?

The Rule of 25 is a guideline used in retirement planning to estimate how much a retiree will need to save to sustain their lifestyle after retirement. According to this rule, a retiree will need to save 25 times the amount that they expect to spend annually during retirement. This rule is based on the 4% withdrawal rate, which suggests that a retiree can withdraw 4% of their retirement savings each year without running out of money for at least 30 years.

How to Calculate Rule of 25?

The following steps outline how to calculate the Rule Of 25.

- First, determine the annual expenses expected during retirement ($).

- Next, gather the formula from above = RS = A * 25.

- Finally, calculate the Rule Of 25.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

annual expenses expected during retirement ($) = 40000